Key takeaways from the Fed meeting

As expected, the Fed cuts rates by 50bps (a nearly unanimous decision, with only one dissenting vote), and the dot plot signals a total of 100bps in rate cuts for the year. The Fed’s basic argument for this decision is that they want to bring monetary policy to neutral at a reasonably fast pace, in a context where progress on inflation is evident, and therefore, there’s no need to continue putting downward pressure on aggregate demand. To reinforce this, Powell explicitly said in the press conference that the economy is solid and that the Fed’s current focus is on ensuring that growth and employment continue to perform well.

– This is good news for risk assets since we have an economy that remains in relatively good shape, coupled with a Fed that is clearly more willing to risk cutting rates too much rather than too little.

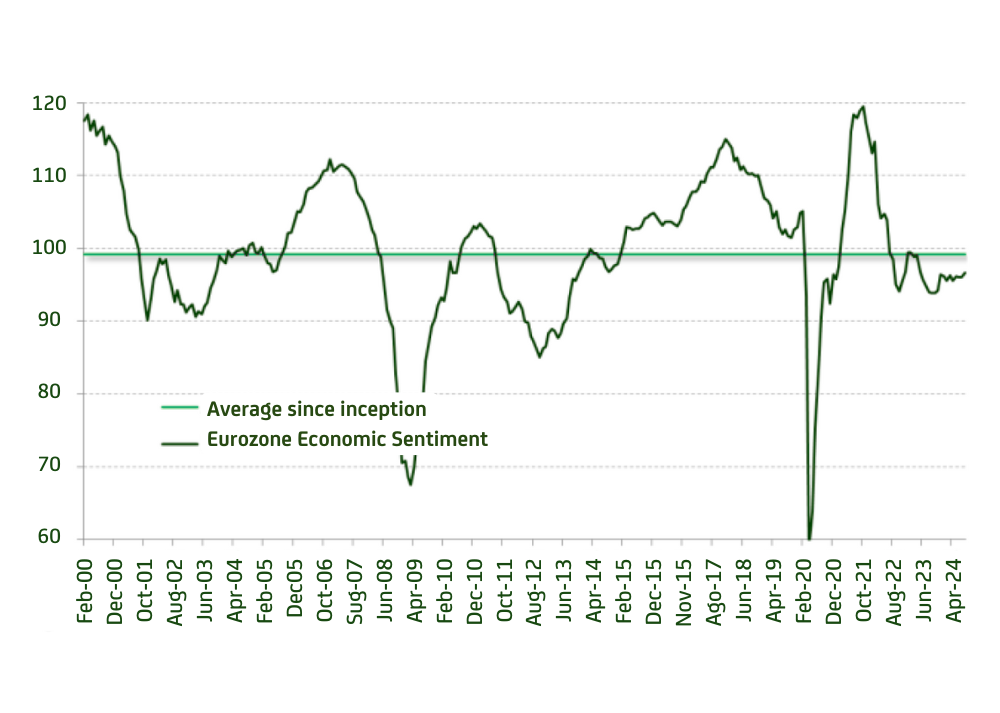

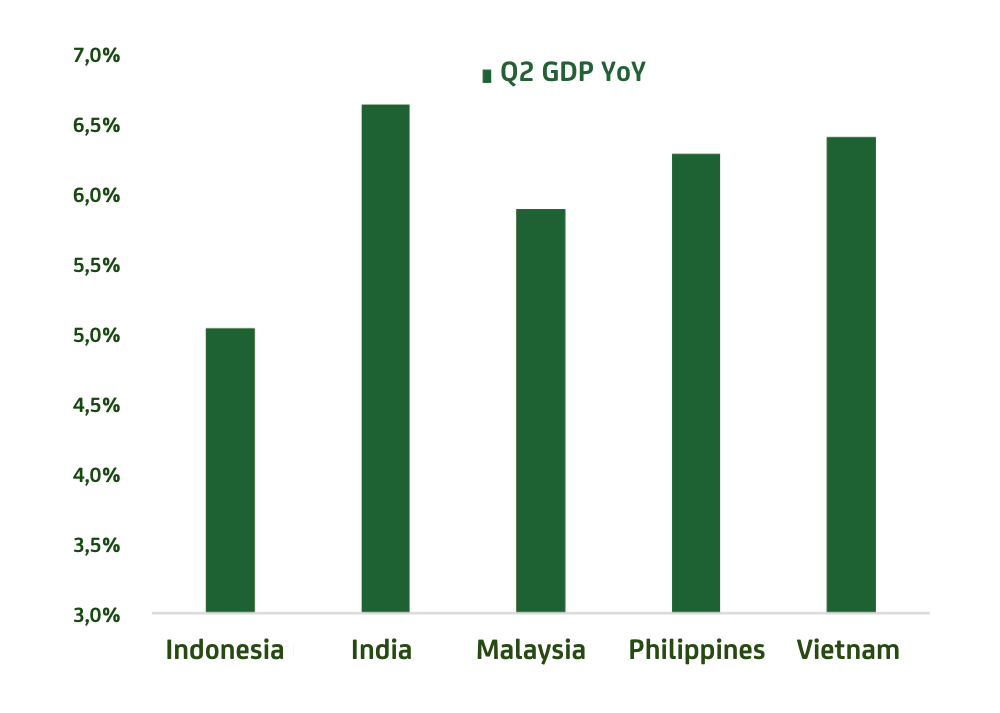

– Specifically, we wouldn’t rule out a particularly positive performance in the coming weeks for mid and small-cap companies, cyclical stocks, and emerging market currencies with attractive carry.

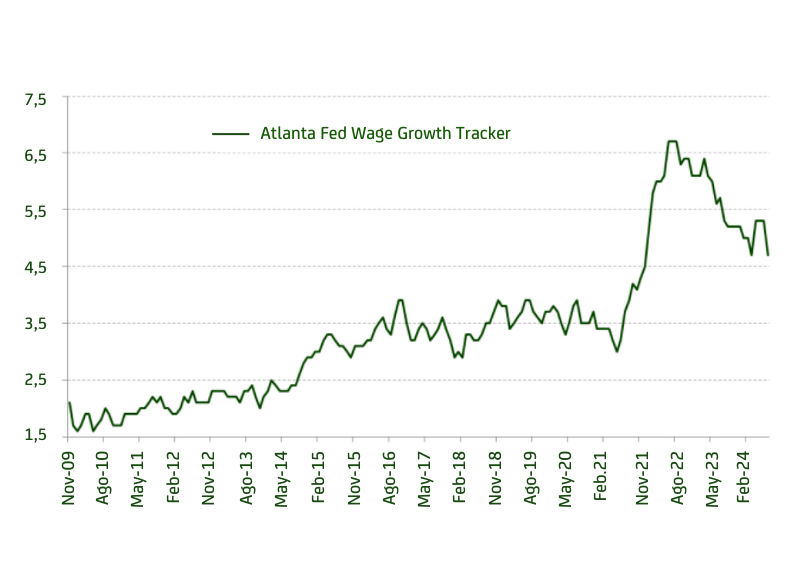

– That said, looking ahead, if financial conditions remain as loose as they are today, it seems quite likely that sooner rather than later we could start to see upward surprises in growth (and perhaps also in prices) in the U.S. economy.

– This, in turn, could lead to new upward revisions in the Fed’s estimate of the neutral rate (which was raised by just one-tenth today, to 2.9%) and could also cause the rate-cutting cycle that began today to end much sooner than currently anticipated.

Our central scenario remains for the Fed’s terminal rate to be around 4%, which coincides with our estimate of neutral and could be reached as early as the first quarter of next year. Naturally, a macro and interest rate scenario like the one described leads us to be very cautious with duration risk.