Macro Update – September 2023

Macro Update – September 2023

Most of the activity data in recent months would point to a clear divergence between the U.S. and the Eurozone economies. In the U.S., despite the Fed’s rate hikes, growth currently seems to be above potential. In the Eurozone, in contrast, macro figures (especially in Germany) are compatible with basically stagnant economic activity.

What can we expect for the latter part of this year and the beginning of 2024? More of the same? We don’t think so. In the case of the U.S. economy, we believe that growth will begin to show signs of moderation sooner rather than later, to rates in line with or below potential. In the Euro area, however, we see several favorable factors that should allow our continent to grow at positive (albeit moderate) rates over the coming quarters.

As far as prices are concerned, the downward trend in core inflation on both sides of the Atlantic is likely to consolidate between now and the end of the year, which will create the necessary conditions for central banks to put a hold on further interest rate hikes. And when will the rate cuts come? As we have noted in previous versions of this letter, we believe that the strong fundamentals currently supporting aggregate demand in most of the developed world make it very likely that rates will remain near current levels for quite some time (and it’s also possible that we could see upward revisions to neutral rate estimates by more than one central bank in the not-too-distant future).

Outside the major developed economies, the focus of pessimism remains on China, with the real estate sector continuing to generate noise and most analysts revising their growth forecasts for the country downward. We believe that China will be able to grow at rates of around 5% in 2023, and we also believe that the Chinese government is right not to listen to the siren songs coming from the markets that are urging it to implement much more aggressive monetary and fiscal stimuli than those implemented to date. As far as Japan is concerned, the goal of achieving sustainable inflation rates of 2% over time seems to be getting closer and closer: growth remains above potential, the output gap is positive, wages continue to accelerate, and inflation excluding fresh food and energy is at multi-decade highs. As such, we believe that, over the coming quarters, the Bank of Japan will continue to take steps to further ease its yield curve control policy.

First Forecast

Although we continue to see no recession, we believe that the U.S. economy is likely to slow down in the coming quarters to rates in line with or somewhat below potential growth due to several reasons:

- Medium and long-term real interest rates now seem sufficiently high to have an appreciable dampening effect on consumption and investment demand.

- The fiscal impulse derived both from the Inflation Reduction Act and from other expansionary budgetary measures adopted by the U.S. authorities recently should lose steam in the coming quarters.

- By the end of this year, the excess savings accumulated during the pandemic by U.S. consumers could have almost completely disappeared.

- The moratorium on student loans will probably not be extended, and this will reduce the spending capacity of a not insignificant number of people as of this October.

US Job Openings Evolution

Second Forecast

Despite the weakness that a lot of macro data has been showing in the recent period, the Eurozone is likely to achieve positive economic growth on average in the coming quarters. Here are the main reasons:

- Consumption, although undoubtedly affected by rate hikes and probably higher than usual levels of uncertainty, is benefiting from significant tailwinds (unemployment rates at record low levels, positive real wage growth…).

- Fiscal policy remains clearly expansionary and thus continues to provide additional support to aggregate demand.

- The possibly imminent end to the downward adjustment process that has been taking place in inventories could also provide some encouragement to the manufacturing sector towards the end of this year or the beginning of 2024.

- Although real interest rates have risen sharply in recent quarters, their current levels are consistent with a degree of monetary tightening that, in our view, is only moderate.

Third Forecast

It is quite possible that, between now and the end of the year, we could see significant falls in core inflation in the U.S. Aside from the fact that monetary policy has perhaps already become sufficiently restrictive to correct the strong excess demand created by the pandemic, there are several factors that should help:

- It is highly likely that the shelter costs component of the underlying CPI will slow very significantly in the coming months.

- Increased immigration is helping increase potential supply and thereby reduce wage and price pressures.

- Inflation expectations remain well anchored, and this also reduces the likelihood of inadequate wage and price behavior in the coming months.

Fourth Forecast

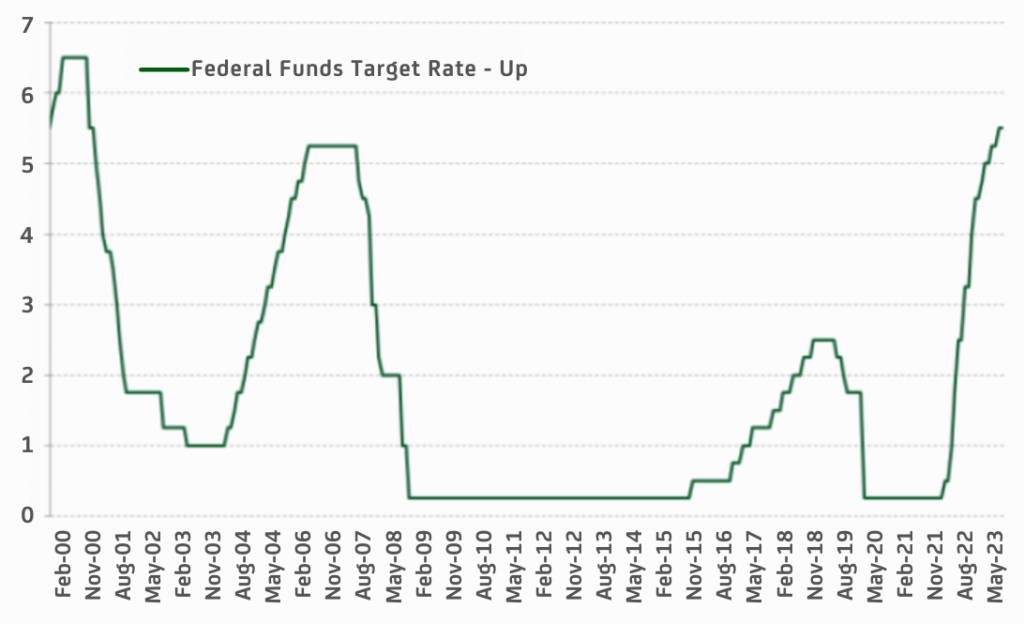

In view of the scenario discussed for the U.S., we have most likely already seen the last rate hike by the Fed in this cycle. At the same time, we continue to believe that interest rates will take a long time to come down, and we also consider it likely that, in the not-too-distant future, there may be upward revisions to neutral rate estimates not only by the Fed but also by central banks in many other countries.

The reasons behind these last two forecasts (high rates for quite some time and upward pressure on neutral rate estimates) are mostly related to the strong underlying fundamentals we see in aggregate demand both in the U.S. and in most of the global economy: healthy consumer and corporate balance sheets, which increases the propensity to consume and invest; significant public-private investment needs in issues related to the green transition; increased military spending; retirement of baby boomers, with what this implies in terms of reduced labor supply relative to potential demand…

Federal Funds Target Rate Evolution

Fifth Forecast

In the Eurozone, the conditions are also in place for core inflation to fall appreciably in the remainder of the year, something which in turn could allow the ECB to begin (maybe already in September) a long period of pausing interest rate hikes.

- Wages have accelerated significantly but have not done so to the point of being able to generate complicated wage-price spirals.

- Inflation expectations in the Eurozone are well anchored.

- Monetary policy has become moderately restrictive, maybe sufficiently so.

Risks

Apart from those of a geopolitical nature, we see mainly two:

- Aggregate demand could prove even stronger than we think. If this were to happen, core inflation would probably remain too high, and that would force central banks to keep raising interest rates. This scenario wouldn’t necessarily be too bad for the market, given that economic growth would remain sustained and it would continue to support corporate earnings and continue to help keep default rates low; having said that, what is also undeniable is that such a scenario, with real rates even higher than they are today, would make certain valuation multiples in some equity segments even more challenging to justify and would also mean that duration could continue to be unpleasant.

- It is not at all impossible that, at some point, inflation expectations could become unanchored, possibly leading to a situation in which central banks would be forced to generate a recession to control price pressures. This wouldn’t, of course, be good news for risk assets. But fortunately, the downward trend that has been occurring in the recent period in both core price data and inflation expectations on the part of consumers and businesses means that, at least for the time being, the likelihood of this second risk scenario is quite low in our view.

China

As far as China is concerned, and without forgetting the risks that undoubtedly exist (including those related to China’s “political” proximity to Russia and the Asian giant’s “competition” with the U.S.), we continue to maintain a reasonably constructive view:

- Growth forecasts for 2023 are still close to 5%, which is by no means negligible and clearly higher than what can reasonably be expected in the developed world.

- No small part of the current weakness of the Chinese real estate sector stems from restrictive measures adopted by the authorities themselves.

- Although the Chinese central government and the PBOC continue to be cautious for the time being, it should not be forgotten that both institutions have more than enough room to increase monetary and fiscal stimulus if they deem it necessary to achieve their growth targets. In fact, recent measures taken by Chinese authorities in recent times are clearly pointing to more (even if still moderate) economic stimulus.

Market vision

Sovereign bonds: Although the U.S. curve has had a significant upward movement in the last two months, we still see more upside risks than downside risks in the intermediate and long maturities. We, therefore, continue to bet on positions focused on short maturities. In the case of the Eurozone, we believe that long rates are still somewhat below their fundamental value and could, therefore, still experience some upside, so we also like the short end of the European curve the most (even more so than in the US case).

Equity: Since we don’t see a recession, we continue to bet on cautious but somewhat constructive equity positions. By style, considering that we see some underlying strength in aggregate demand and that we do not rule out further upward movements in the middle and long end of the interest rate curves, we think that the value/cyclical segment of the market (including European banks) should do better than the growth/defensive segment.

Credit: We are betting on moderate positions in short-term corporate bonds. On the positive side, our central macro scenario is compatible with default rates remaining reasonably low. On the downside, the current low levels of spreads call for some caution in our view. Against this backdrop, we believe it makes sense to combine moderate exposure to low-duration credit with well-selected positions in local currency emerging government bonds.

Currencies: We have a positive view of currencies such as NOK, NZD, or AUD, as they offer an attractive combination of carry, macro stability, high rating, and, in the case of the latter two, an indirect way to gain exposure to the Chinese reopening. At the same time, with rates possibly peaking in the US, we also continue to like emerging market currencies with good macro governance, solid growth prospects, and reasonably high levels of carry (MXN, BRL, IDR, INR).

This report has been prepared by AMCHOR Investment Strategies SGIIC, S.A. (“AMCHOR IS”) an entity participated by the Alantra Group and incorporated as an investment firm authorized and supervised by the CNMV, registration number 273 with registered office at Calle Velázquez Nº 166, 28002 Madrid (Spain).

This report is addressed only to professional investors for internal and exclusive use. The information contained herein shall only be distributed as permitted by applicable law and AMCHOR IS and the Alantra Group specifically forbid the redistribution of this document in whole or in part without its prior written permission.

Nothing in this report constitutes a representation from AMCHOR IS or the Alantra Group that any investment strategy or recommendation contained herein is suitable or appropriate to a recipient’s individual circumstances or otherwise constitutes a personal recommendation. This report is published solely for information purposes, it does not constitute an advertisement and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments in any jurisdiction. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor it is intended to be a complete statement or summary of the securities or financial markets referred to in this report.

AMCHOR IS and the Alantra Group do not (i) endorse, guarantee nor represent that investors will obtain profits nor (ii) accept any liability for any investment that the recipients may carry out and incur in losses arising from adopting the recommendations included in this report or its contents. Investments involve risks and investors should exercise prudence in making their investment decisions. This information has been extracted from public sources that AMCHOR IS considers reliable and is not responsible for its truthfulness or accuracy. This report should not be regarded by recipients as a substitute for the exercise of their own judgement. Any opinions expressed in this report are subject to change. The analysis contained herein is based on numerous assumptions, hypothesis and forecasts. Different assumptions could result in materially different results. AMCHOR IS and the Alantra Group are under no obligation or keep current the information contained in this report.

The investor should note that the financial market is fluctuating and as such is subject to variations. The price of investments (which may be quoted in illiquid markets) may change and the investor may not get back the amount initially invested. The figures contained herein relate to the past. Past performance is not a reliable indicator of future results.