Macro Update – October 2023

Macro Update – October 2023

The core components of our central macroeconomic outlook have not changed since the previous month. Here’s a summary:

- We still expect most countries to avoid recession, at least a serious one.

- The U.S. economy is likely to slow down, growing slightly below its potential by the end of the year due to higher real interest rates, reduced fiscal stimulus, decreased pandemic-related savings, the end of student loan relief, and a strengthening U.S. dollar.

- The Eurozone is expected to achieve modest growth from the fourth quarter, supported by low unemployment, wage acceleration, excess savings, lower real interest rates compared to the U.S., and short-term fiscal policies.

- Below-potential growth in the U.S. and Europe, coupled with stable inflation expectations and increased labour force due to immigration, could lead to a significant drop in underlying inflation on both sides of the Atlantic by mid-next year.

- We anticipate the Federal Reserve and the European Central Bank to avoid further interest rate hikes in this cycle, although interest rates are expected to remain elevated for some time. Many central banks may even raise their neutral interest rate estimates in the next 6-12 months.

- China’s economy is expected to improve in the latter part of the year, and Japan is on track to stabilize inflation around 2%, allowing the Bank of Japan to consider normalization of its monetary policy by next spring.

Additionally, we will explore “economic” risks that could disrupt our outlook this month, including:

- The possibility of greater economic fragility leading to a short-term recession risk.

- Conversely, the potential for aggregate demand to show more resilience than expected, necessitating central banks to resume interest rate hikes.

- An uncontrollable surge in crude oil prices that could disrupt inflation expectations.

- Market concerns about the sustainability of public debts in some countries, potentially causing excessive tightening of financial conditions.

First risk

The potential impact of the recent rise in real interest rates on economic stability. There is a concern that this upward shift in real interest rates could lead to greater economic weakness than we anticipate, possibly even pushing major economies into a recession in the near future. It’s important to note that our perspective is that the fundamentals supporting global aggregate demand are currently strong, so the current level of real interest rates may not be sufficient to trigger a significant economic contraction. Nevertheless, we will remain vigilant and closely monitor activity data in the upcoming weeks to detect any signs of greater economic weakness than we currently expect.

Second risk

The possibility that the economies remain in a situation of excess demand, especially in the U.S. This might prevent a sustained decrease in underlying inflation, potentially leading to too-rapid wage increases and unanchoring inflation expectations. In response, central banks would have to resume interest rate hikes, possibly aggressively. Unfortunately, this scenario could then result in a recession starting in mid-2024.

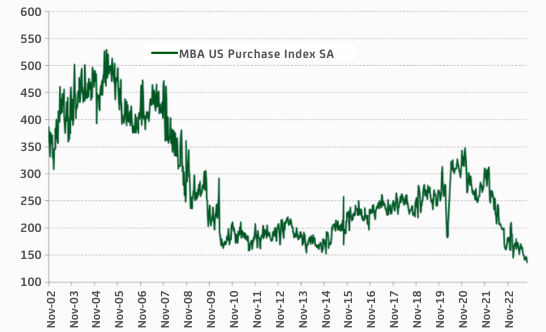

We assign only a moderate probability to this scenario. We believe that current real interest rates are already high enough to keep economies growing below potential, which should lead to further declines in underlying inflation in the coming months. To ensure this outcome, it’s important for global fiscal policies to shift away from expansion as soon as possible. Monitoring the budgets proposed by different countries for 2024 will therefore be crucial. It would also be beneficial if U.S. data continues to confirm signs of a gradual correction of strong excess demand generated after the pandemic, such as the recent decline in home purchase mortgages and wage moderation data.

Third risk

A potential negative supply shock, possibly triggered by a rapid increase in oil prices. If, for instance, oil prices were to rise significantly above $100 and remain there for an extended period, it would create a challenging “alternative” scenario. This scenario would be problematic for several reasons:

- It would combine economic weakness with high inflation.

- The renewed inflationary pressures, following a period of upward price pressure, could lead to the unanchoring of inflation expectations, resulting in demands for too-rapid wage increases and further significant price hikes by businesses.

- In this scenario, central banks would be compelled to raise interest rates, which, given the economic weakness resulting from a negative supply shock, could lead to a recession in many economies, possibly as early as the first half of next year.

How likely is it for something like this to happen? The likelihood of a significant and sustained increase in oil prices from current levels is relatively low. Several factors contribute to this assessment:

- Saudi Arabia, a leading member of OPEC+ production cuts, would ironically face adverse consequences in such a scenario. Political pressure from the U.S. and other importing countries would mount against Saudi Arabia. A global recession resulting from high oil prices would quickly reduce the physical demand for Saudi oil. Additionally, exorbitant oil prices would incentivize the acceleration of renewable energy adoption, leading to long-term reductions in oil demand.

- Recent conflict in Israel is not expected to lead to direct reprisals from Israel against Iran, nor do we anticipate Iran escalating the conflict. Such direct involvement by Iran could hinder its efforts to ease sanctions.

Fourth risk

The potential loss of market confidence in the sustainability of public debt in certain countries. If this were to occur, it could result in a significant tightening of financial conditions, making it challenging for these economies to avoid slipping into a recession. Furthermore, such a situation is likely to increase overall market volatility.

To prevent this risk from materializing, it’s crucial for countries with high debt ratios and particularly excessive levels of structural public deficits to promptly present credible budget consolidation programs. This step is essential to ensure that markets maintain trust in public debts.

Sovereign Bonds:

- In the U.S., the yield curve may have reached fair value. Our focus though is still on the short end (up to 2 years) of the curve, pending economic slowdown confirmation.

- In the Eurozone, the mid to long end of the curve has shifted upward, but there is a risk of further increases. Cautious approach to peripheral debt.

- For Japan, the forecast is a significant rise in the 10-year yield over the next 6-9 months.

Equity:

- Given the macroeconomic outlook in the U.S. and Europe avoiding a recession, the value/cyclical market segment is preferred over growth/defensive.

- European and Asian markets are favored over the North American market.

Credit:

- Corporate fixed income is still favorable, expecting no significant increase in default rates.

- Combine credit exposure with well-selected positions in emerging market local currency debt. Attractive due to good return prospects and strong economic governance in some emerging countries.

Currencies:

- The dollar may continue to appreciate if the U.S. economy doesn’t slow down, but only very moderate exposure to the dollar is favored.

- The yen (in small amounts) is considered a protective position.

- Positive views on currencies like the Norwegian Krone (NOK), the New Zealand Dollar (NZD), the Australian Dollar (AUD), and emerging market currencies with strong governance and growth prospects.

This report has been prepared by AMCHOR Investment Strategies SGIIC, S.A. (“AMCHOR IS”) an entity participated by the Alantra Group and incorporated as an investment firm authorized and supervised by the CNMV, registration number 273 with registered office at Calle Velázquez Nº 166, 28002 Madrid (Spain).

This report is addressed only to professional investors for internal and exclusive use. The information contained herein shall only be distributed as permitted by applicable law and AMCHOR IS and the Alantra Group specifically forbid the redistribution of this document in whole or in part without its prior written permission.

Nothing in this report constitutes a representation from AMCHOR IS or the Alantra Group that any investment strategy or recommendation contained herein is suitable or appropriate to a recipient’s individual circumstances or otherwise constitutes a personal recommendation. This report is published solely for information purposes, it does not constitute an advertisement and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments in any jurisdiction. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor it is intended to be a complete statement or summary of the securities or financial markets referred to in this report.

AMCHOR IS and the Alantra Group do not (i) endorse, guarantee nor represent that investors will obtain profits nor (ii) accept any liability for any investment that the recipients may carry out and incur in losses arising from adopting the recommendations included in this report or its contents. Investments involve risks and investors should exercise prudence in making their investment decisions. This information has been extracted from public sources that AMCHOR IS considers reliable and is not responsible for its truthfulness or accuracy. This report should not be regarded by recipients as a substitute for the exercise of their own judgement. Any opinions expressed in this report are subject to change. The analysis contained herein is based on numerous assumptions, hypothesis and forecasts. Different assumptions could result in materially different results. AMCHOR IS and the Alantra Group are under no obligation or keep current the information contained in this report.

The investor should note that the financial market is fluctuating and as such is subject to variations. The price of investments (which may be quoted in illiquid markets) may change and the investor may not get back the amount initially invested. The figures contained herein relate to the past. Past performance is not a reliable indicator of future results.