Macro Update – May 2023

Macro Update – May 2023

Over the last few weeks, the (slight) moderation observed in some macro data and the persistent risks (regional banking in the US, debt ceiling, war in Ukraine, etc.) have led the market to expect a scenario for the US economy characterized by three basic elements:

- the first, a recession in the short term (albeit probably mild);

- the second, a relatively rapid moderation of inflation; and

- the third –consistent with the first two– a Federal Reserve forced to lowering interest rates well before the end of the year

However, we still don’t quite agree with this narrative for the reasons explored below.

We believe that aggregate demand in the US and the Eurozone is in very good shape – this implies monetary policies will have to remain tight longer than currently assumed. We do not see rate cuts this year in either the US or Europe, and we also believe that the European Central Bank (ECB) may have to raise rates at least once or twice more in its next few meetings.

We continue to see signs that the Chinese economy is likely to bounce back significantly over the year, and in this circumstance, together with an emerging Asian region that is generally strong, may provide relevant additional support for global aggregate demand over the coming quarters.

In addition, from a medium-term perspective, we see reason to believe that,- once the current period of high inflation is over and monetary policies can cease to be restrictive – the world in which we will likely live will not be one of zero rates and deflationary pressures, but one in which inflation risks will be reasonably symmetric and neutral rates will probably be somewhat higher than what is currently priced in.

This belief is backed by, on one hand, the aggregate demand in many countries seemingly enjoying structurally favorable tailwinds – households and companies with good balance sheet positions; lower levels of risk aversion than was the norm after the international financial crisis; greater need for public and private investment associated with the energy transition; higher military spending, etc. On the other hand, there are several factors that may hinder an efficient supply response to this perhaps more dynamic demand – retirement of baby boomers and therefore less labor supply, friend shoring, nearshoring, among others.

What are the implications for the market? We consider it likely that the assets that have been doing best since the beginning of the year (growth, technology, gold, duration, etc.) will probably fair relatively worse for the remainder of the year.

In last month’s macro update we explained why we saw it unlikely that the problems that have been observed in some US banks could eventually lead to a ‘catastrophic’ tightening of financial conditions. As far as the debt ceiling is concerned, we believe that it is likely to be solved without major shocks, albeit at the last minute (to do otherwise could lead to questioning the dollar’s role as a reserve currency and the consideration of US treasury bonds as the ultimate risk-free asset par excellence).

If these risks (as well as the geopolitical ones still hovering over us) remain reasonably under control, we consider the following elements to be relevant to understand the current situation of the global economy.

First, although some indicators have been showing signs of moderation, this does not necessarily mean that the US economy is on the verge of recession. On the contrary, we believe the maximum that can be concluded so far is that the US (fortunately) seems to be starting to correct the enormous excess demand generated in the aftermath of the pandemic.

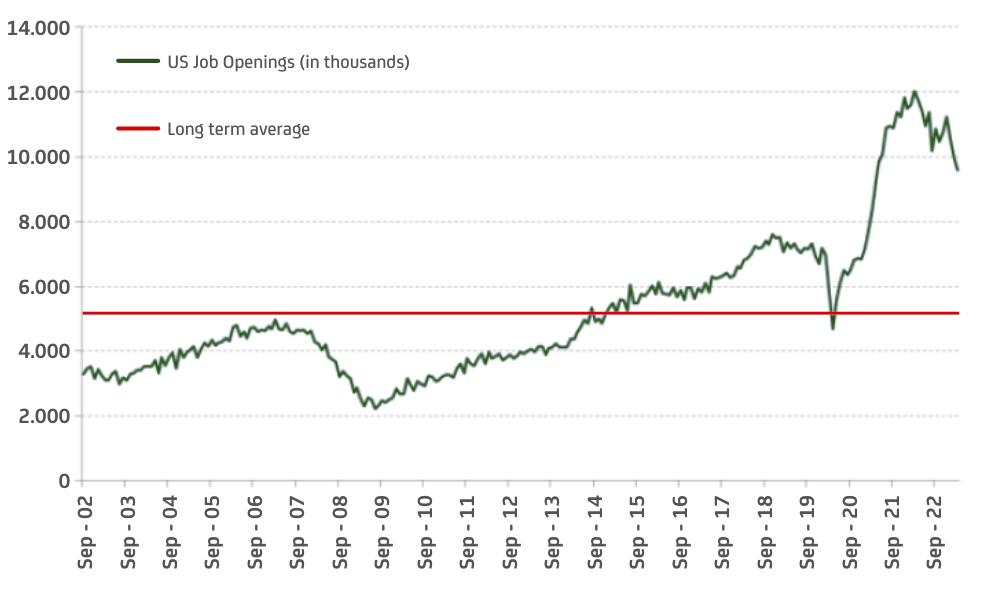

Perhaps the best example of this is the drop in job vacancies since their peak. Yes, vacancies have gone down. But it is also undeniable that their current levels are not only incompatible with a worrisome cooling of the US labor market, but rather point to a labor market that remains very strong and in which more companies are looking to hire than people looking for a job. To illustrate this, bear in mind that the ratio of vacancies to unemployed is today 1.6x; in comparison in 2019 – with a job market at full employment at the time – it was ‘only’ 1.2x.

Evolution of job openings in the US

Additionally, the GDP growth for the first quarter has indicted ‘growing weakness’ in the US economy, 1.1% quarter-over-quarter annualized, a rate in theory clearly below potential.

However, it is reasonable to conclude that the US economy continues to show much underlying strength. Two examples that support this assertion are: private consumption grew at annualized quarterly rates of 3.7% in Q1, while falling inventories detracted almost 2.3 points from growth in that period.

We should also not lose sight of two additional elements. On the one hand, the US real estate sector – theoretically one of the most sensitive to rates – is not only not “collapsing” but has been showing signs of stabilization in recent months. On the other hand, the April labor data continues to show a very strong job market, in terms of job creation, falling unemployment and wage dynamism (in fact, average wages per hour worked increased to their highest month-on-month rate since March 2022).

Second, inflation expectations of US companies continue to move in the right direction, making it more credible that the Fed can control inflation without having to bring the US economy into a recession.

Evolution of inflation expectations in the US

Third, labor market and service sector data in the Eurozone not only do not point to recession but are closer to being compatible with a certain acceleration of economic activity.

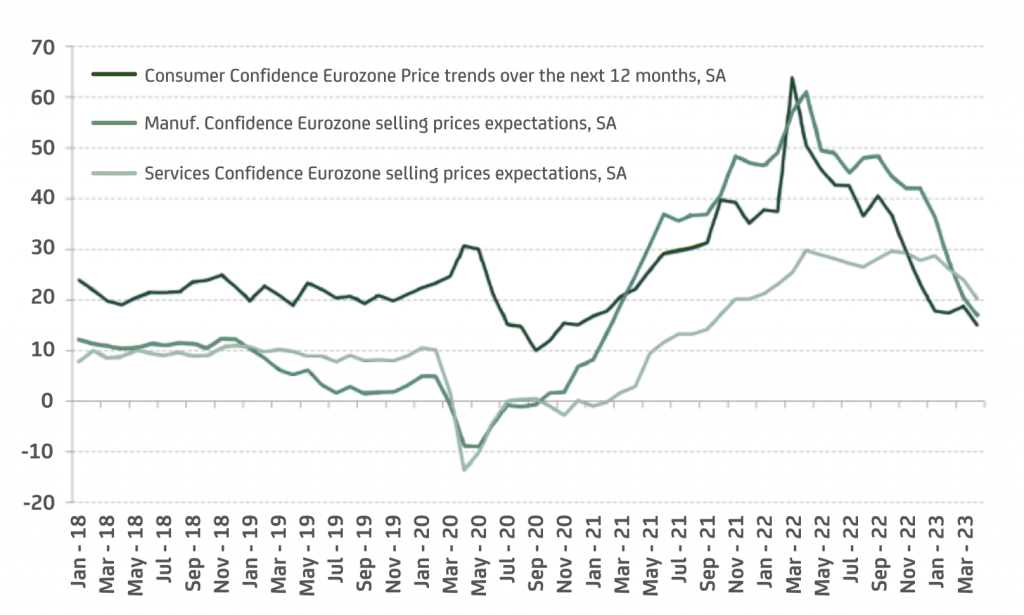

Fourth, inflation expectations in the euro area also seem to be moderating and this, as in the case of the US, makes it plausible that a soft-landing scenario for economic activity may be sufficient to achieve a gradual moderation of inflationary pressures in the coming quarters.

Evolution of inflation expectations in the Eurozone

Fifth, immigration is on the rise in many developed countries, and this is potentially very good news in scenarios of excess demand such as the current one. Immigration, by way of increasing potential supply more than aggregate demand, makes it more likely that inflation can be controlled while maintaining positive rates of economic growth. The mechanism that explains this would be as follows: the entry of immigrants increases the number of workers and, thus, the country’s potential supply but, on the expenditure side, part of the income generated by these new workers is not transformed into domestic consumption but rather filters out of the country in the form of remittances. This in turn allows the growth in aggregate demand associated with immigration to be less than the effect of immigration on potential supply.

Sixth, at least for the time being, the problems that are being observed in some US regional banks are not generating a disorderly tightening of financial conditions (bank deposits in the US remain stable since the end of March, bank credit shows no signs of shrinking, credit spreads have not exploded to the upside).

Seventh, looking ahead, the strong degree of bank disintermediation that has long characterized the US financial system reduces the likelihood that the rumblings that are currently affecting regional banking in the US generate anything resembling a recession.

Eighth, without leaving aside all the risks, we believe that we will also have to be very attentive to the evolution of food and energy prices. If they were to notably increase, headline inflation could end the year at rates that are still too high, which in turn could lead to a very critical chain of events – significant second-round effects on wages and prices; even more aggressive rate hikes by central banks; and, if that happens, a recession (possibly a significant one) as a very likely scenario for 2024.

Market overview

Government debt: Unless the state of the banking system or the debt ceiling debate become much more complex than we expect, we believe that interest rates are going to stay relatively high for much longer than currently discounted by the markets. As it is, we continue to see very little attractiveness in duration risk, in both Europe and the US. In Japan, we continue to believe that the Bank of Japan will be forced to abandon its yield curve control policy in the coming months and that this justifies short positions in the Japanese 10-year.

Credit: We still favor corporate bonds with low durations as default rates should not increase significantly in our central macro scenario. In any case, we maintain our commitment to combine this credit exposure with well-selected positions in local-currency emerging government bonds. The latter asset class is appealing to us for the good return prospects (both in terms of carry and potential exchange rate appreciation) and for the current group of emerging countries for which we expect very attractive rates of economic growth, and which also benefit from sound economic governance, low public deficits, and reasonably low inflation rates. These characteristics make the exposure to local-currency government bonds in these countries clearly less risky than has been the case in the past.

Equities: To the extent that we see underlying strength in aggregate demand and this leads us to think about upward shifts in the interest rate curves between now and the end of the year, we believe that the value/cyclical segment of the market (including banks) should perform better than growth/defensive segment. Geographically, considering the relative valuation levels, we favor the European market more than the US market. At the same time, and although we are aware of the geopolitical risks in China, we believe that Asia is clearly going to be the fastest growing region globally in both the short and medium term, and for this reason we continue to favor some exposure to equities in this region.

Currencies: Dollar levels in the vicinity of 1.10 (or even better if it reaches 1.12) seem sufficiently appealing to us to make this currency a good hedge for euro investors. At the same time, and in view of the positive signals from Japan, we believe that the yen could also be a good hedge position for the remainder of the year. In addition, we also see certain currencies such as the pound and the Norwegian krone as attractive. Finally, as mentioned above, we continue to favor emerging currencies of countries with good macro governance and attractive carry levels.

This report has been prepared by AMCHOR Investment Strategies SGIIC, S.A. (“AMCHOR IS”) an entity participated by the Alantra Group and incorporated as an investment firm authorized and supervised by the CNMV, registration number 273 with registered office at Calle Velázquez Nº 166, 28002 Madrid (Spain).

This report is addressed only to professional investors for internal and exclusive use. The information contained herein shall only be distributed as permitted by applicable law and AMCHOR IS and the Alantra Group specifically forbid the redistribution of this document in whole or in part without its prior written permission.

Nothing in this report constitutes a representation from AMCHOR IS or the Alantra Group that any investment strategy or recommendation contained herein is suitable or appropriate to a recipient’s individual circumstances or otherwise constitutes a personal recommendation. This report is published solely for information purposes, it does not constitute an advertisement and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments in any jurisdiction. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor it is intended to be a complete statement or summary of the securities or financial markets referred to in this report.

AMCHOR IS and the Alantra Group do not (i) endorse, guarantee nor represent that investors will obtain profits nor (ii) accept any liability for any investment that the recipients may carry out and incur in losses arising from adopting the recommendations included in this report or its contents. Investments involve risks and investors should exercise prudence in making their investment decisions. This information has been extracted from public sources that AMCHOR IS considers reliable and is not responsible for its truthfulness or accuracy. This report should not be regarded by recipients as a substitute for the exercise of their own judgement. Any opinions expressed in this report are subject to change. The analysis contained herein is based on numerous assumptions, hypothesis and forecasts. Different assumptions could result in materially different results. AMCHOR IS and the Alantra Group are under no obligation or keep current the information contained in this report.

The investor should note that the financial market is fluctuating and as such is subject to variations. The price of investments (which may be quoted in illiquid markets) may change and the investor may not get back the amount initially invested. The figures contained herein relate to the past. Past performance is not a reliable indicator of future results.