Macro Update – March 2023

Macro Update – March 2023

If we focus exclusively on January’s activity and price data in the United States, the conclusion would likely be that the US economy has begun a process of reacceleration that will make it very difficult for the Fed to contain inflationary pressures without aggressive action in terms of further interest rates hikes.

However, we believe that some of what we have seen in the US during the first month of the year could be transitory in nature. Firstly, changes in seasonal patterns in the wake of the pandemic might have upwardly skewed January’s activity and price data. Secondly, higher-than-normal temperatures at the beginning of the year may also have temporarily favored activities in certain segments of the services sector (e.g., catering). And thirdly, and most importantly, it is highly likely that the strength shown by the US economy in the first weeks of 2023 may have also been due to the softening of financial conditions that occurred between November 2022 and January of this year. As an example, the yield on the 10-year US bond fell below 3.40% during the period in question; however, that process has been mostly undone in February and yields are now again close to 4%.

With this backdrop in mind, as long as financial conditions remain at levels of tightness similar to what we are seeing currently, we believe the most likely scenario is that the US economy will once again return to the soft landing that prevailed during the latter part of 2022. More specifically we expect economic growth to be below potential (but not recessionary) in the coming quarters, with wage and price pressures progressively edging down.

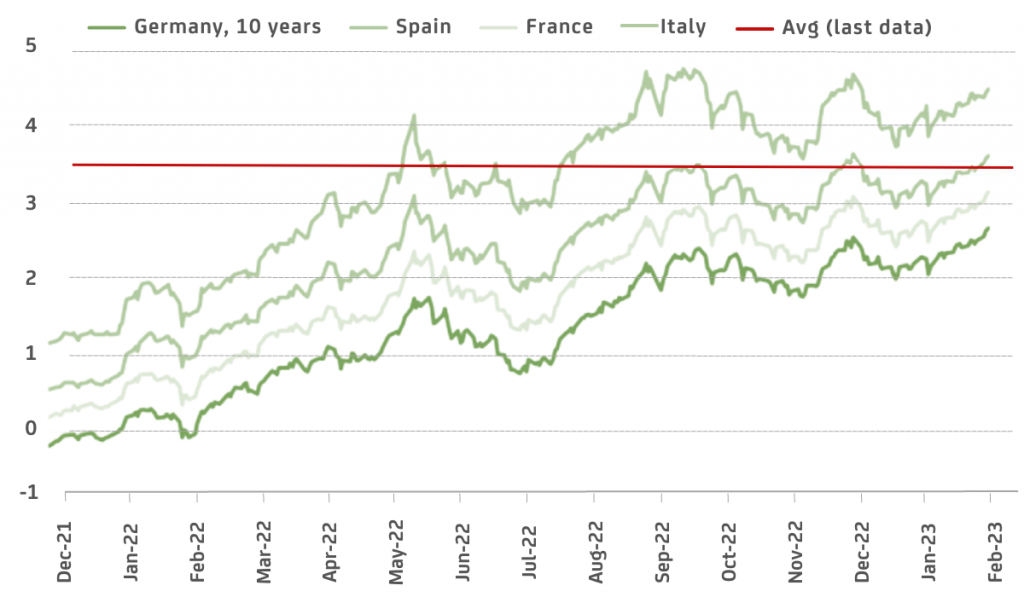

For the Eurozone, the macro scenario going forward could be similar to the one just described for the US. If financial conditions remain in a reasonably tight territory (a German 10y above 2.6/2.7% seems compatible with that), we expect underlying inflation to peak and then edge down from March/April onwards, with economic growth in 2023 likely to be low but positive.

Outside the US and the Euro area, as we have noted previously, we remain quite hopeful that economic growth will turn out to be strong in both China and Southeast Asia during 2023.

As far as potential risks are concerned, we’ll be looking out for two things in particular: possible signs that inflationary pressures are taking longer to moderate than we expect, and potential complications derived from the war in Ukraine.

In the US, most of January’s macro data points to renewed strength in economic activity, with price pressures also stronger than expected.

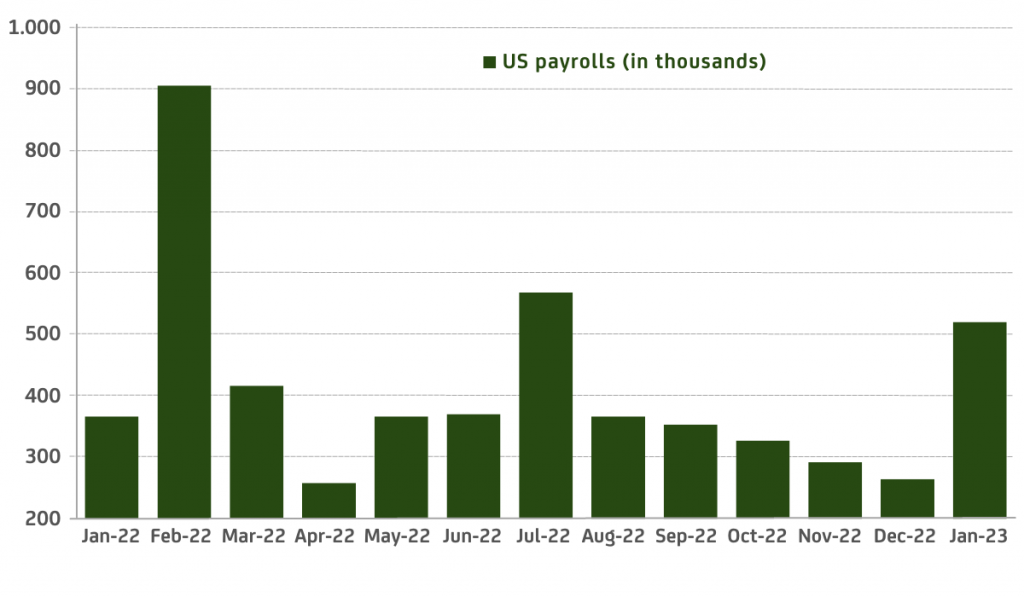

Evolution of US payrolls

As noted in the executive summary, we believe that it is possible that some of the dynamism seen in January in the US economy may prove to be temporary, partly because already during the month of February financial conditions have tightened significantly again and this is something that should help to cool demand pressures going forward.

In fact – and perhaps as a first sign that in March we may see some moderation in US activity data – mortgage application data from the last two weeks is showing that the real estate sector is once again being pushed down by higher long-term interest rates.

We therefore believe, if the yield curve remains at levels seen at the end of February, the most likely scenario for the US economy is that of a soft landing. In this scenario, the Fed is likely to raise interest rates once or twice more and keep them there until it sees clear evidence that underlying inflation is moving sustainably towards the 2% target rate.

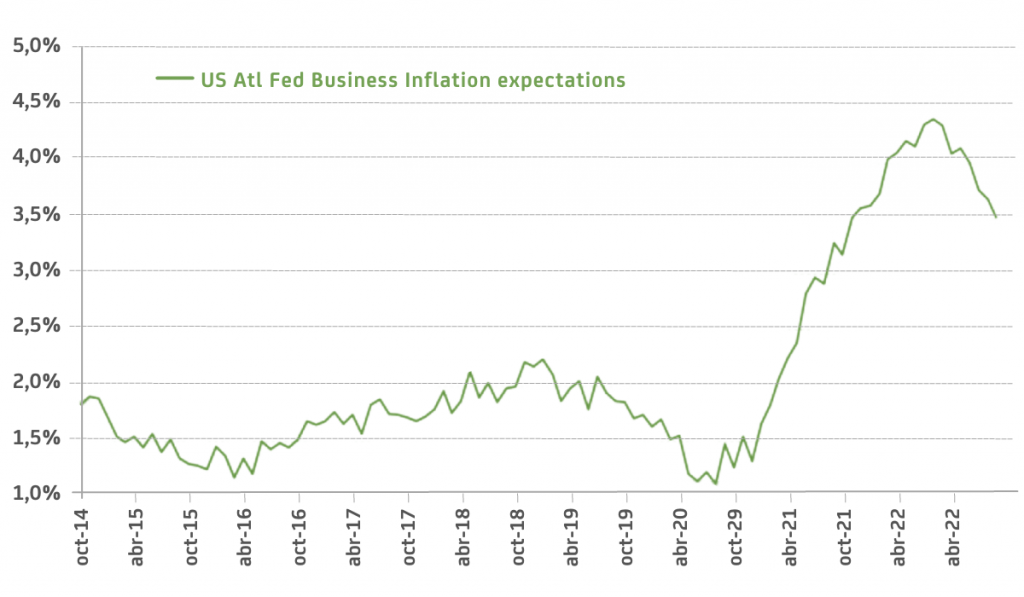

Why will it be possible for the Fed to bring inflation under control without creating a recession? Although several factors are at play the main element that makes a soft landing a real possibility this time around is the fact that medium- and long-term inflation expectations remain very well anchored. Indeed, this is a key element that differentiates the current inflationary period from other similar market conditions at various times in history when it was very difficult for the Fed to control prices without causing significant economic pain. In the same sense, we find it very positive that short-term inflation expectations have also headed in the right direction for several months now.

Evolution of inflation expectations in the US

In Europe, partly because the ECB was much slower and more hesitant than the Fed in tightening its monetary policy, there is still no sign of any moderation in prices or wages.

However, it is undeniable that the ECB’s change of attitude since last December has greatly contributed to significantly tighter financial conditions in the Eurozone as a whole.

ECB rate path

Looking ahead – and although very difficult to predict precisely – a terminal rate in the range of 3.5% for the deposit rate in the Eurozone seems to be sufficient to ensure that, from March or April onwards, underlying inflation will begin to progressively edge down.

As for China and Southeast Asia, there is nothing to add to what has already been said in previous months: we remain optimistic about the macro performance of this region throughout 2023.

Regarding risks, although we would all like to know with certainty the exact level of neutral rates and how far above neutral rates (and for how long) central banks will have to go to control inflation, the truth is that this is not possible -we will have to wait and see. If indeed economic activity and price pressures begin to soften again in the near future, the Fed would not be forced to raise rates much further. If, on the other hand, growth and inflation remain at unsustainably high rates, the Fed would be forced to turn even more aggressive. In turn, this would greatly increase recessionary risks further down the road.

At the same time, in the case of the Eurozone and for similar reasons to the US, we will have to be particularly vigilant that wages do not accelerate much beyond the 4.5% annual growth rate that we have as our central scenario. The reason for this is that growth well above the rates just indicated would most likely generate harmful second-round effects, which would then make European inflation even more persistent and would force the ECB to increase rates more than what we currently expect.

Apart from the risks related to inflation persistence it will also be necessary to continue to pay close attention to “non-economic” risks. In this respect, we are most concerned about the following: possible desperate actions on Putin’s part, such as trying to sabotage energy supplies to Europe coming from third countries; potential Chinese faux pas, for example, excessive support to Russia by the Asian giant that could lead to sanctions being imposed on the latter; and an “unamicable” resolution of the debt ceiling debate in the United States.

Market perspective

On the market side, our view can be summarized as follows:

- Government bonds: It seems that yield curves in the US and Europe are fairly priced. Actually for the first time in a long time -and with the US 10y above 3.90% and Germany 10y above 2.60% – it seems to us that having a moderate exposure to the long end of the curves could be a good idea for protection against possible negative shocks that could occur in the coming months. In Japan, on the other hand, we continue to see significant upside risks for the 10y bond yield since we believe that the BOJ will be forced to further ease its yield curve control policy in the coming months, especially if wages start to grow above 3% from Spring onwards (the latter seems increasingly likely and would be even more significant if growth is not only concentrated in large companies, but also extends to SMEs)

- Credit: We continue to see the benefits in corporate bonds because in our main macro scenario default rates should not increase as much. However, we are a little bit less upbeat about corporate credit than we used to be. In fact, given the fall in spreads that has occurred in recent months, we see an increasing number of reasons to combine this asset class with exposures to emerging government bonds in local currency in countries with good macro performance and a strong institutional setup

- Equities: In our view, although the correction seen in February in US equities has diminished the symptoms of overvaluation in that market, we continue to prefer European and Asian equities to US equities. At the same time, the resilience being shown by economic activity in Europe and the US leads us to believe that interest rates will remain high for some time to come. In that sense, we would not wager on having an excessive amount of exposure to growth – although some exposure to the small companies’ segment in the US and Europe, which offers attractive valuations in relative terms, could do well in our soft-landing scenario

- Currencies: Dollar levels in the range of 1.10 (or even better 1.12, if it comes to that) seem attractive to us to make this currency a good hedge for euro investors. Additionally, and if we see sufficient wage dynamism in Japan in the coming weeks, the yen could also be in a good hedging position for the remainder of the year. Otherwise, and if our scenario of a soft landing in the US is confirmed, we favor carefully selected emerging market currencies

Álvaro Sanmartín Antelo, Partner and Chief Economist at AMCHOR Investment Strategies.

Alantra holds a strategic stake in AMCHOR IS, an independent product specialist that selects best-in-class international asset management firms and structures alternative investment funds for distribution to Spanish, Italian, and Portuguese investors. Founded in 2008, AMCHOR currently represents or manages more than €5bn AuM.

This report has been prepared by AMCHOR Investment Strategies SGIIC, S.A. (“AMCHOR IS”) an entity participated by the Alantra Group and incorporated as an investment firm authorized and supervised by the CNMV, registration number 273 with registered office at Calle Velázquez Nº 166, 28002 Madrid (Spain).

This report is addressed only to professional investors for internal and exclusive use. The information contained herein shall only be distributed as permitted by applicable law and AMCHOR IS and the Alantra Group specifically forbid the redistribution of this document in whole or in part without its prior written permission.

Nothing in this report constitutes a representation from AMCHOR IS or the Alantra Group that any investment strategy or recommendation contained herein is suitable or appropriate to a recipient’s individual circumstances or otherwise constitutes a personal recommendation. This report is published solely for information purposes, it does not constitute an advertisement and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments in any jurisdiction. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor it is intended to be a complete statement or summary of the securities or financial markets referred to in this report.

AMCHOR IS and the Alantra Group do not (i) endorse, guarantee nor represent that investors will obtain profits nor (ii) accept any liability for any investment that the recipients may carry out and incur in losses arising from adopting the recommendations included in this report or its contents. Investments involve risks and investors should exercise prudence in making their investment decisions. This information has been extracted from public sources that AMCHOR IS considers reliable and is not responsible for its truthfulness or accuracy. This report should not be regarded by recipients as a substitute for the exercise of their own judgement. Any opinions expressed in this report are subject to change. The analysis contained herein is based on numerous assumptions, hypothesis and forecasts. Different assumptions could result in materially different results. AMCHOR IS and the Alantra Group are under no obligation or keep current the information contained in this report.

The investor should note that the financial market is fluctuating and as such is subject to variations. The price of investments (which may be quoted in illiquid markets) may change and the investor may not get back the amount initially invested. The figures contained herein relate to the past. Past performance is not a reliable indicator of future results.