Macro Update – June 2023

Macro Update – June 2023

Data on US economic activity continues to show very strong signs that a recession in the second half of the year is unlikely. Equally, recent indicators of wage and underlying inflation are also appearing to move in the right direction. In the case of the Eurozone, activity in the Services sector remains strong, while unemployment has reached new record lows in April. On the price side, however, Europe still has a longer way to go than the US, as wages continue to accelerate and – due in part to the strength of the tourism sector – it is not impossible that we could see further rises in core inflation over the summer.

Amid this backdrop, our macro scenario has not changed and can be summarized in four elements:

- first, aggregate demand in the US and Europe enjoys a solid base;

- second, this solid base and the significant fiscal and monetary stimuli enacted during the pandemic have contributed to a situation of excess demand, which has led to significant inflationary pressures;

- third, as a consequence of the above, restrictive monetary policies are now needed for a relatively long period of time to moderate both inflation and wages; and

- fourth, inflation expectations remain reasonably anchored which makes it possible to control inflation without having to go through a recession – when the price outlook remains close to central banks’ targets, and in order to bring inflation down, it is theoretically sufficient to correct excess demand, without the need for monetary policy to become so restrictive as to create situations of excess supply, as was the case in the 1970s, for example.

With this context, we therefore believe the Fed may have peaked on rates. However, the European Central Bank will likely have to raise rates twice more at the June and July meetings. Looking further ahead, we believe that we are going to have to wait until well into 2024 to see interest rate cuts. In terms of risks, the one that worries us the most is probably that inflation might take longer to fall than we expect, something that we think could de-anchor inflation expectations and force central banks to raise interest rates beyond what we envisage in our central scenario. If that were to happen, a more or less significant recession through 2024 would be difficult to avoid.

With this scenario as a backdrop, below we analyze why we believe recent activity and price data continue to be compatible with this outcome:

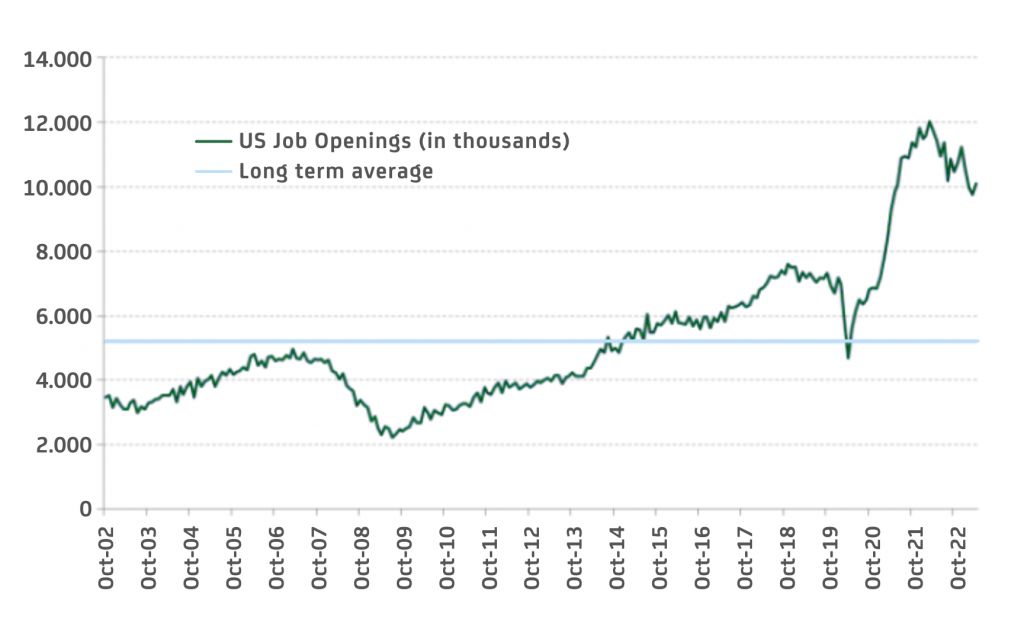

US labor market: Although it seems to be losing some ‘temperature’, the US labor market does not point to an excessive cooling. In fact, the latest vacancy data has picked up again and shows extraordinarily high values (the vacancy/unemployed ratio is 1.8 vs. 1.2 before the pandemic). In addition, the pace of job creation remains extraordinarily high (314,000 jobs per month on average so far this year).

Evolution of job openings in the US

Labor market in the Eurozone: The data indicates that the job market in Europe remains strong (the Eurozone created employment at annualized rates close to 2.5% in Q1 and reached a new low for the unemployment rate in April).

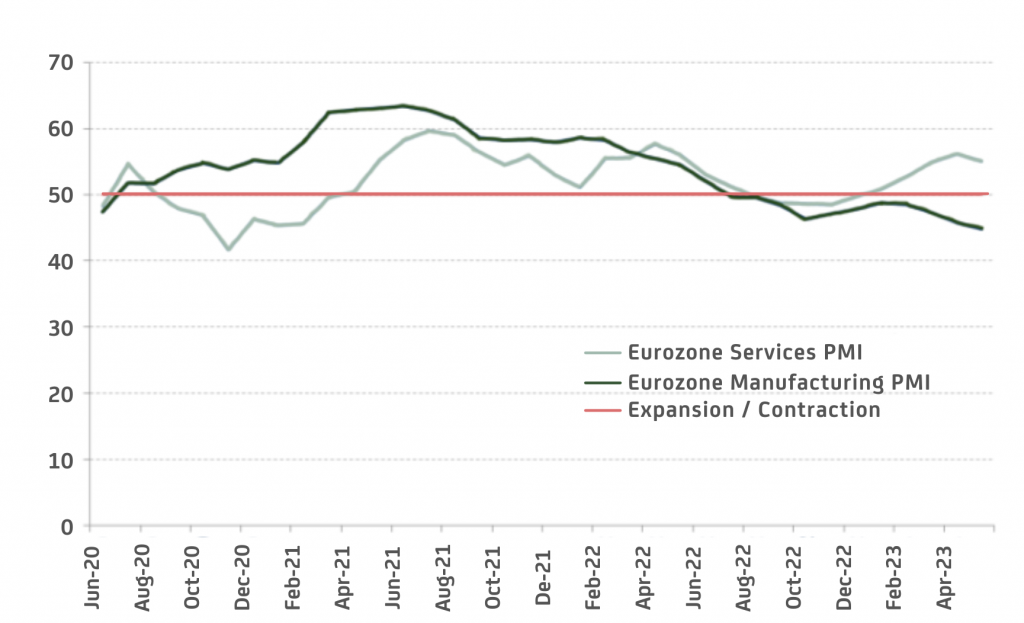

Manufacturing vs. Services sector: We do not believe that the relative weakness of the manufacturing sector in the US and the Eurozone is giving an early sign of what could soon happen to the Services sector. In our view, what is happening is that having favored goods during the pandemic, global aggregate demand has now shifted towards Services – e.g. there are very few countries that are not expecting record levels of tourism this summer.

Evolution of the Eurozone’s PMI

Germany as a leading indicator for the Eurozone: Analysts have looked to Germany’s negative growth data in Q1 to conclude that the European economy is set to show very little dynamism in the coming quarters. We believe that this may be a mistake for the following reasons:

- part of the weakness that Germany has shown over the past two quarters is idiosyncratic and is due to its significant dependence on Russian energy supplies. Italy, in the same quarter, was able to grow at annualized rates of close to 2.5%, an example on why what happens in Germany is not always a guide to what happens in other European countries; and

- the German economy has begun to show some signs of recovery at the beginning of the second quarter of the year (the Services sector is showing strength, exports have increased, and the month of April’s job creation figure was once again very positive)

US price and wage indicators: Signs of wage moderation in the US, combined with the expected favorable evolution of the CPI shelter component in the coming months, point to a short-term continuation of the (gradual) disinflation that already seems to have started in the US economy. At the same time, the recovery of immigration that has been observed in the US and other countries is good news as it makes it more possible to combine disinflation with positive GDP growth.

US housing market: The signs of stabilization in the US residential segment – theoretically one of the most sensitive to rate hikes – point to the Fed’s monetary policy being only moderately restrictive at present. This, together with the positive indicators from underlying prices and wages, reinforces our view that the US will be able to control inflation without going into recession.

Financial conditions: In the previous Macro Update, we explained why we consider the problems seen in some US regional banks as unlikely to translate into anything resembling a credit crunch: good banking conditions in general (both in terms of capital and liquidity); significant activism on the part of authorities to inject liquidity; strong disintermediation in the US financial system, which has reduced the dependence of non-financial companies on bank credit; and high levels of cash on corporate balance sheets, so that the corporate investment is now less dependent on credit than it has been in other moments in history. The most recent indicators confirm that, at least for the time being, there is no question of a credit crunch in the US (stabilization of deposits and bank lending, a drop in the use of the Fed’s liquidity injection facility, calm credit spreads, etc.).

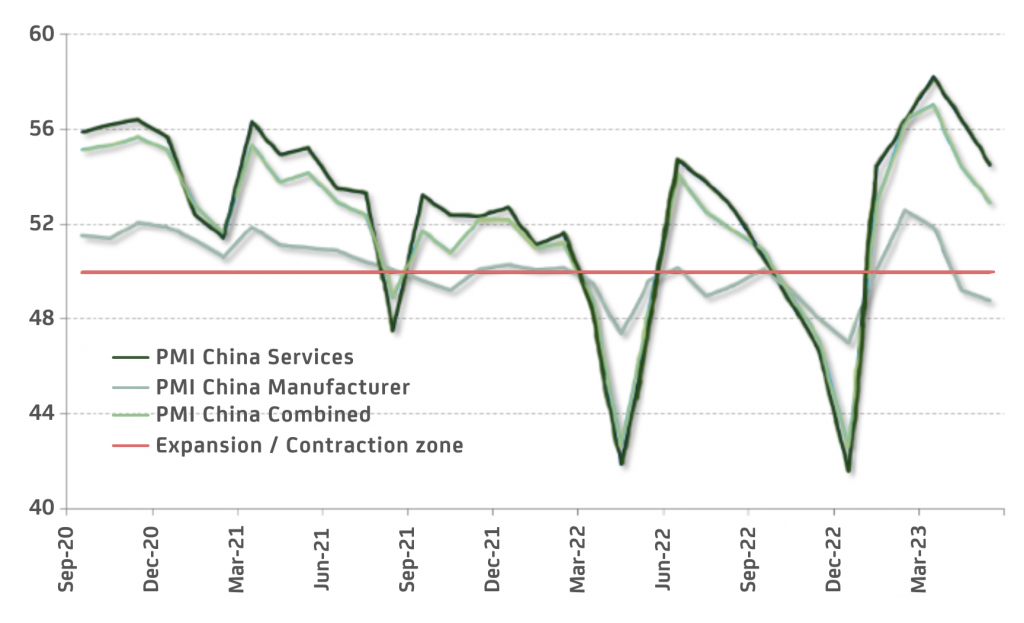

China: Without denying several factors of concern (geopolitical instability, high youth unemployment…), China’s Services sector continues to show strength and the overall unemployment rate is at low levels (5.2%) and falling. At the same time, the residential segment continues to show signs of stabilization.

With the above in mind, we believe it is highly unlikely that the Asian giant will not grow at a rate of over 5.5% for the year. In fact, despite the prevailing negative market sentiment, the reality is that almost all Analysts have raised their Chinese growth forecasts for 2023 compared to what they anticipated at the beginning of the year.

Evolution of China’s PMI

Rest of emerging Asia: India continues to show strong growth, with inflation reasonably under control and very moderate current-account deficits. In our view, Southeast Asia’s prospects are also quite favorable. We expect this group of countries to grow by around 4-5% in 2023, in-line with potential. The reason for the apparently high growth in these regions is the notably reduced number of fiscal and monetary stimulus during the pandemic when compared to Europe and the US. This subsequently resulted in less inflation overshooting, allowing their central banks to conduct less aggressive monetary policies.

Japan: Against a backdrop of accommodative fiscal and monetary policies and having fairly recently removed the last restrictions associated with the pandemic, the Japanese economy is currently growing above potential and the output gap is turning positive. This, in turn, is bringing the Bank of Japan (BOJ) closer to its target of bringing inflation steadily to rates in the vicinity of 2%. In fact the latest wage and core inflation data show growth rates not seen in 40 years – a sign of the significant progress Japan has made in its fight against deflation. Therefore, we believe that the Japanese economy is creating a very favorable environment for the BOJ to be able to ease its curve control policy again in the coming months.

Risks: Without discounting the downside risks related to economic activity, we will be following closely the possibility that inflation may take longer to fall than we estimate. A potential delay may affect inflation expectations, forcing central banks to conduct even tighter monetary policies than we are expecting. In this regard, and to analyze whether this risk is likely to materialize, between now and the end of the year we will closely monitor variables including:

- Rental prices in the US – private sources have shown signs of an upturn in the last two and this could anticipate a future acceleration in the shelter component of the CPI

- Wage growth – especially in the Eurozone to verify that they do not go above 4.5-5%

- Energy and food prices – Saudi Arabia’s recent decision to cut crude oil production may help to keep energy prices high, while possible adverse weather events could have a significant impact on food prices

- Consumer and corporate inflation – to verify that medium-term inflation expectations remain reasonably anchored and that short-term expectations confirm the moderation they have been showing in recent months

- The fiscal policy stance in Europe and the US – it would be welcomed if, with the output gap already positive and inflation so high, fiscal policies could (at the very least) become neutral, helping central banks in their goal of moderating aggregate demand growth

Market overview

Government fixed income: As noted above, and although the latest upward movement has put yield curves at more reasonable levels, we still believe that interest rates will remain relatively high for longer than is now being discounted. Moreover, we do not rule out future upward revisions to neutral rate estimates. These are the reasons why we still do not see much value in duration risk, neither in Europe or in the US. In Japan, we continue to believe that the BOJ will be forced to relax its curve control policy in the coming months and that this justifies short positions in the Japanese 10-year bond.

Credit: We still prefer corporate bonds with low durations as in our macro scenario default rates should not increase too much. Conversely, we maintain our commitment to combine this credit exposure with well-selected positions in local-currency emerging government bonds. The latter asset class appeals to us for two reasons: because it offers good return prospects (both in terms of carry and potential appreciation of the exchange rate); and because there is currently a group of emerging countries for which we expect very attractive rates of economic growth, which also benefit from sound economic governance, low public deficits, and reasonably low inflation rates. In our view, these characteristics make the exposure to local-currency government bonds in these countries less risky than in the past.

Equities: To the extent that we see underlying strength in aggregate demand and reasonably high interest rates over the medium term, we believe that the value/cyclical segment of the market (including banks) should do better than the growth/defensive segment in the second part of the year. Geographically, considering the above and relative valuation levels, we prefer the European market over the North American one. While we are aware of the geopolitical risks in China, we also believe that emerging Asia is clearly going to be the fastest growing region globally in both the short and medium term. For this reason, we continue to favor some exposure to equities in this region.

Currencies: Seeing the positive signs that Japan is generating and since the yen is quite depreciated on a fundamental basis, we believe that the Japanese currency could be a good hedge position for the remainder of the year. As for the rest, we continue to prefer emerging currencies from countries with good macro governance and attractive carry levels. At the same time, we believe that the Norwegian krone could benefit in the remainder of the year from a possible rise in the price of crude oil.

This report has been prepared by AMCHOR Investment Strategies SGIIC, S.A. (“AMCHOR IS”) an entity participated by the Alantra Group and incorporated as an investment firm authorized and supervised by the CNMV, registration number 273 with registered office at Calle Velázquez Nº 166, 28002 Madrid (Spain).

This report is addressed only to professional investors for internal and exclusive use. The information contained herein shall only be distributed as permitted by applicable law and AMCHOR IS and the Alantra Group specifically forbid the redistribution of this document in whole or in part without its prior written permission.

Nothing in this report constitutes a representation from AMCHOR IS or the Alantra Group that any investment strategy or recommendation contained herein is suitable or appropriate to a recipient’s individual circumstances or otherwise constitutes a personal recommendation. This report is published solely for information purposes, it does not constitute an advertisement and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments in any jurisdiction. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor it is intended to be a complete statement or summary of the securities or financial markets referred to in this report.

AMCHOR IS and the Alantra Group do not (i) endorse, guarantee nor represent that investors will obtain profits nor (ii) accept any liability for any investment that the recipients may carry out and incur in losses arising from adopting the recommendations included in this report or its contents. Investments involve risks and investors should exercise prudence in making their investment decisions. This information has been extracted from public sources that AMCHOR IS considers reliable and is not responsible for its truthfulness or accuracy. This report should not be regarded by recipients as a substitute for the exercise of their own judgement. Any opinions expressed in this report are subject to change. The analysis contained herein is based on numerous assumptions, hypothesis and forecasts. Different assumptions could result in materially different results. AMCHOR IS and the Alantra Group are under no obligation or keep current the information contained in this report.

The investor should note that the financial market is fluctuating and as such is subject to variations. The price of investments (which may be quoted in illiquid markets) may change and the investor may not get back the amount initially invested. The figures contained herein relate to the past. Past performance is not a reliable indicator of future results.