Macro Update – July 2023

Macro Update – July 2023

The US economy continues to show signs of resilience, confirming that the risk of recession for the remainder of the year is quite low. At the same time, it seems that the Fed’s moderately restrictive monetary policy is starting to correct the strong excess demand generated after the pandemic. As far as core prices are concerned, signs of a gradual moderation continue due to interest rate hikes and well anchored inflation expectations.

Amid this backdrop, our main scenario for the US remains unchanged: moderate but positive economic growth for the remainder of the year; progressive inflation control; one additional rate hike in July, followed by an extended pause; and a flattening yield curve – with the short end remaining close to where it is now and the middle and long end shifting slightly upwards from June’s closing levels.

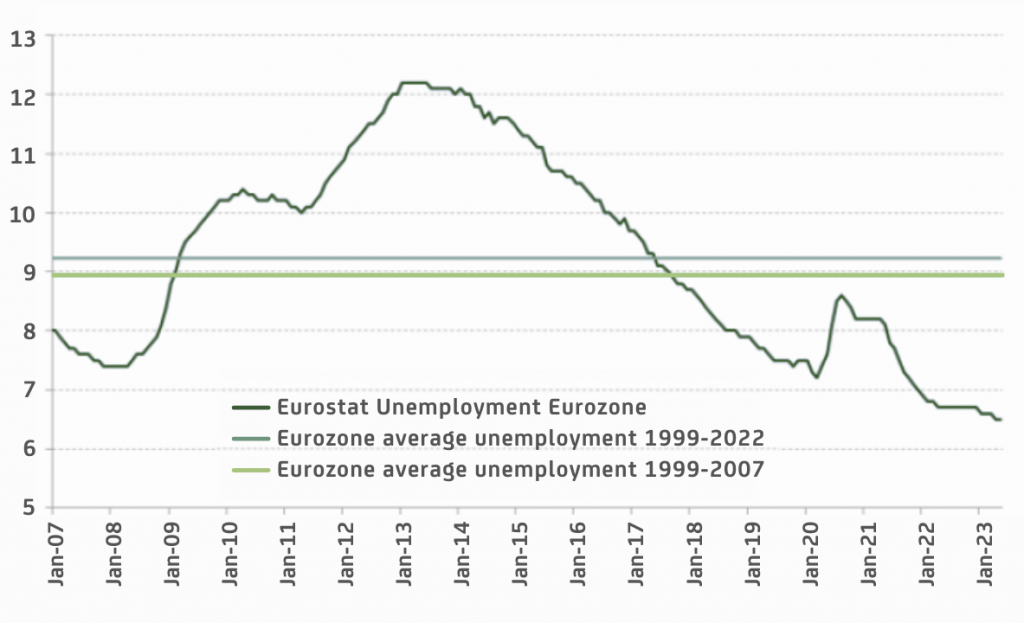

In the Eurozone, we believe that the weakness shown by recent macro data will be short-lived. Our main scenario for the Eurozone continues to point to moderate but positive growth in the coming quarters, with the tourism sector enjoying a favorable outlook and aggregate demand still benefiting from significant tailwinds such as an expansionary fiscal policy, falling prices of imported commodities, rising wages, unemployment at historic lows, and a strong balance sheet of households and companies. As for the European Central Bank’s (ECB) monetary policy, we expect an additional rate hike in July, a prolonged pause after that and a flattening yield curve due to an upward movement in the middle and long end of the curve.

In Japan, recent indicators show growth above potential, with the output gap already in positive territory, core inflation above the Bank of Japan’s (BOJ) target, and good prospects in terms of wage growth.

We continue to see excessive pessimism about China and we have a positive outlook for emerging Asia as a whole, with some encouraging signs also appearing in several Latin American economies. Our assessment thus remains the same as in previous months: though there are ongoing risks that could turn into negative shocks for growth, we will also be paying attention to the possibility of core inflation taking too long to come down, potential de-anchoring of inflation expectations, further interest rate hikes, and a possible economic recession in 2024.

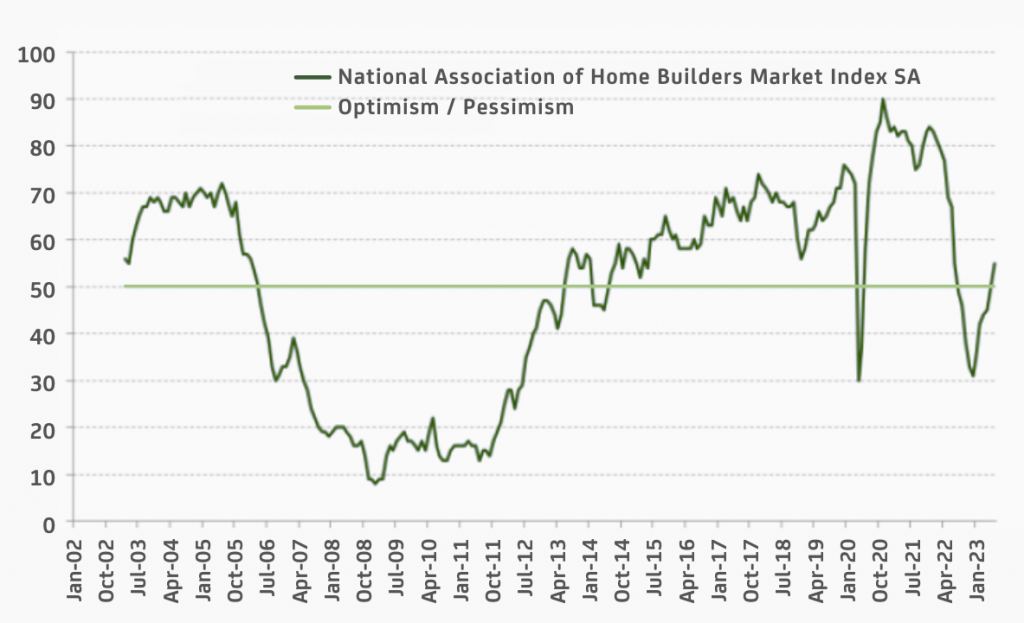

The real estate sector is perhaps the best example of the US economy’s resilience. Although in theory the real estate sector is one of the most sensitive to rate hikes, throughout June we have seen a recovery in US construction companies’ confidence levels, with housing and building permits beginning to rebound.

US construction companies’ confidence levels

Simultaneously, signs of a slight moderation in aggregate demand are beginning to appear – which is very positive, as it is a necessary condition for inflation to be brought under control.

As for the industrial sector, we are seeing weaknesses that could be interpreted as a sign that the US economy will enter a recession on the second half of the year. However, we believe it is important to keep in mind that the sector’s performance was heavily skewed upwards in the immediate aftermath of the pandemic. This was for two reasons. Firstly, global aggregate demand initially shifted towards goods to the detriment of services, as the latter took longer to normalize. Secondly, industrial companies, fearful of supply cuts, exaggerated order levels to ensure ‘reserve’ inventories. Therefore, we believe that it is quite possible that a significant part of the weakness observed today in the manufacturing sector of many countries is more a reflection of the normalization of past excesses than a leading indicator of recession.

Overall, medium-term inflation expectations in the US remain well anchored, while short-term inflation expectations have been flexing downward – both of which are essential to control inflation without monetary policy having to become so restrictive as to generate a recession. Progressively, these well-anchored price expectations and somewhat more moderate aggregate demand are allowing core inflation to start moving in the right direction. The downward inflation trend could gain traction in the coming months, as official indices begin to reflect more clearly the significant slowdown that has already been observed for some time in housing rental prices.

In turn, resilient but moderate economic activity, well-anchored inflation expectations and core inflation starting to flex downward, pave the way for the Fed to halt its rate hikes after the July meeting and take a long pause thereafter. We believe that for the Fed to start lowering rates, there will have to be simultaneous signs of significant weakness in both activity and prices, something we see as unlikely in the coming quarters.

In the Eurozone, despite the weakness shown by certain data recently, we believe that a macro scenario like that of the United States will eventually prevail. We believe that the healthy aggregate demand fundamentals mentioned above will lead to moderate but positive growth for the remainder of the year, with unemployment remaining close to historic lows. We also deem that core inflation will soon start to show signs of moderation, due to the ECB’s monetary policy and well anchored price expectations in Europe. This, in turn, could allow the ECB to raise rates one last time in July and then begin a long pause starting at its September meeting.

Eurozone unemployment levels

In China, in our opinion, geopolitical risks are leading to an excessively negative assessment of the country’s macroeconomic situation. In this regard, we continue to believe that Chinese economic growth is very likely to be around or even above 5.5% this year, with a service sector that has a favorable outlook and a real estate sector that we do not believe is going to give any major scares.

Meanwhile, we remain positive about emerging Asia as a whole: we expect growth in line with potential in 2023, falling inflation, low public deficits, good current account balance, etc. We also see encouraging signs in certain Latin American economies such as Mexico and Brazil.

As for Japan, it continues to enjoy appreciable “post-pandemic” tailwinds – the last restrictions to prevent contagion were only lifted at the end of last year, meaning that sectors such as tourism still have plenty of room for recovery. The Japanese economy is also benefiting from monetary and fiscal policies that continue to be clearly expansionary. As a result, we believe that we are likely to see two things in the coming quarters. On the one hand, economic growth will tend to be above potential, with an increasingly positive output gap. On the other hand, underlying prices and wages should continue to show considerable strength. Both elements, in turn, will open the door for the BOJ to ease its yield curve control policy again, perhaps as soon as this July or, if not, before the end of the current fiscal year.

Market overview

Government bonds: We continue to believe that interest rates will remain relatively high for longer than currently discounted by the markets. As noted above, we do not rule out that in the coming quarters we could see a progressive flattening of yield curves in both the US and Europe, with the short end remaining close to June closing levels and the middle and long end moving slightly upwards. We continue to see clear upside risks on the Japanese yield curve.

Equities: We believe that the value/cyclical segment of the market (including European banks) should outperform the growth/defensive segment, as we see the US and Europe’s economies holding up well and given that we do not rule out further upward shifts in yield curves in the coming quarters. Geographically, in view of the above and relative valuation levels, we prefer European and emerging Asia markets to North American markets.

Credit: We also continue to like corporate bonds as in our main macro scenario, default rates should not increase too much. As spreads have fallen significantly again, in our view, it makes sense to combine credit exposure with well-selected positions in local currency emerging government bonds. The latter asset class is attractive because it offers very good return and also because there is currently a group of emerging countries, benefiting from sound economic governance, low public deficits, and reasonably controlled inflation, for which we expect high relative growth rates. These latter characteristics, in our view, make exposure to the local currency debt from these countries less risky today than might appear at first glance.

Currencies: Dollar levels around 1.10 would be attractive enough to make this currency a good hedge for euro investors. At the same time, and seeing the positive signals that Japan is generating, we believe that the yen could also be a good hedge position for the remainder of the year. Otherwise, we have a positive view on currencies such as the NOK, the NZD or the AUD. We also continue to favor currencies of emerging countries with good macro governance.

This report has been prepared by AMCHOR Investment Strategies SGIIC, S.A. (“AMCHOR IS”) an entity participated by the Alantra Group and incorporated as an investment firm authorized and supervised by the CNMV, registration number 273 with registered office at Calle Velázquez Nº 166, 28002 Madrid (Spain).

This report is addressed only to professional investors for internal and exclusive use. The information contained herein shall only be distributed as permitted by applicable law and AMCHOR IS and the Alantra Group specifically forbid the redistribution of this document in whole or in part without its prior written permission.

Nothing in this report constitutes a representation from AMCHOR IS or the Alantra Group that any investment strategy or recommendation contained herein is suitable or appropriate to a recipient’s individual circumstances or otherwise constitutes a personal recommendation. This report is published solely for information purposes, it does not constitute an advertisement and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments in any jurisdiction. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor it is intended to be a complete statement or summary of the securities or financial markets referred to in this report.

AMCHOR IS and the Alantra Group do not (i) endorse, guarantee nor represent that investors will obtain profits nor (ii) accept any liability for any investment that the recipients may carry out and incur in losses arising from adopting the recommendations included in this report or its contents. Investments involve risks and investors should exercise prudence in making their investment decisions. This information has been extracted from public sources that AMCHOR IS considers reliable and is not responsible for its truthfulness or accuracy. This report should not be regarded by recipients as a substitute for the exercise of their own judgement. Any opinions expressed in this report are subject to change. The analysis contained herein is based on numerous assumptions, hypothesis and forecasts. Different assumptions could result in materially different results. AMCHOR IS and the Alantra Group are under no obligation or keep current the information contained in this report.

The investor should note that the financial market is fluctuating and as such is subject to variations. The price of investments (which may be quoted in illiquid markets) may change and the investor may not get back the amount initially invested. The figures contained herein relate to the past. Past performance is not a reliable indicator of future results.