Macro Update – February 2024

Macro Update – February 2024

The American economy is robust, and inflation is moderating, reducing the likelihood of the Federal Reserve raising interest rates again in the current cycle. There’s even a possibility of rate cuts later this year, but the anticipated 5 or 6 cuts seem excessive, risking challenges in controlling inflation.

In the Eurozone, our stance remains unchanged. We expect positive growth surprises in 2024, leading to a smaller-than-anticipated interest rate cut by the European Central Bank. A positive outlook is maintained for emerging Asia, some Ibero-American economies, and China, with expectations of better-than-consensus performance. Japan is also expected to see growth above potential, rising wages, sustained inflation, and a gradually normalizing monetary policy.

Despite the anticipated decline in inflation, we believe the Federal Reserve (FED) may be limited to lowering interest rates by 2 or 3 times in 2024:

- Firstly, the economy’s dynamic growth suggests monetary policy might not be as restrictive due to a potentially higher neutral rate (“r*”).

- Secondly, robust growth alongside very low unemployment raises the risk of demand-driven price pressures.

- Thirdly, a resurgence of inflation before stabilizing at the 2% target could unsettle consumer and business price expectations, complicating inflation control without triggering a recession.

- Lastly, the significant drop in recent inflation doesn’t automatically translate into higher real interest rates, as medium and long-term inflation expectations remain well-anchored, affecting “ex ante” real interest rates differently than “ex post” rates.

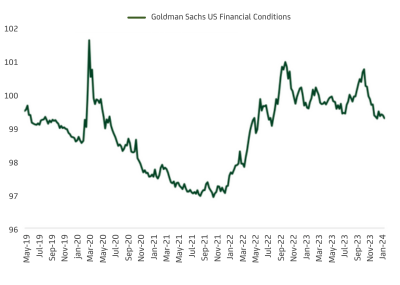

It’s also crucial to note that financial conditions depend on factors beyond risk-free interest rates, including equity risk premium and credit spreads. Recent months have seen a noticeable easing of financial conditions, taking these additional variables into account.

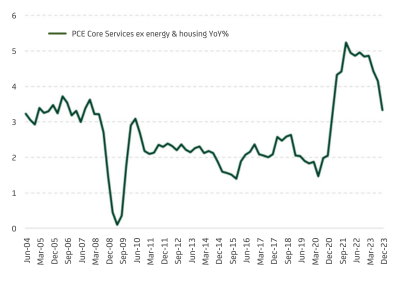

Moreover, while core inflation has declined due to goods deflation, sustained strength in service prices is essential to consider. At the same time, despite accelerated productivity in 2023, dynamic wage growth persists.

Anticipating an economic upturn in the Eurozone this year, several factors contribute:

- Private consumption benefits from wage growth above inflation, historically low unemployment, and strong household finances.

- The potential conclusion of the industry’s downward inventory adjustment may turn into a favorable tailwind.

- Real interest rates at moderate levels from an economic policy perspective should support the Eurozone’s economic trajectory.

- Amid healthy economic growth, wage dynamism, and gradual inflation decline, it is expected that the European Central Bank (ECB) will likely not significantly lower interest rates beyond 2 or 3 times in 2024.

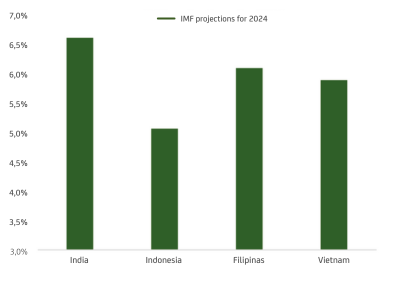

Many emerging economies, particularly in Asia, exhibit encouraging prospects. Firstly, they can grow significantly above the average of developed countries. Secondly, their growth occurs in a context of stable macroeconomic conditions, marked by low public debt, controlled inflation, independent central banks, substantial foreign exchange reserves, and robust current account balances.

In the case of China, there’s a possibility of positive surprises in the current year. Firstly, monetary and fiscal authorities are more active compared to 2023. Secondly, the real estate sector’s downward adjustment might be less severe than the previous year. Thirdly, the downward adjustment process of inventories, akin to Europe, may be concluding. Fourthly, the geopolitical confrontation with the United States seems to have somewhat diminished. Lastly, recent macroeconomic data, while not exceptional, points in the right direction, including industrial company profits, credit growth, exports, and some service sector indicators.

The Japanese economy sets a favorable backdrop for the Bank of Japan (BOJ) to advance in monetary policy normalization during the first part of the year. With growth growth looking healthy going forward, very low unemployment, sustained increases in inflation expectations, and inflation excluding energy and food consistently above the 2% target, the only remaining factor for BOJ to feel comfortable reducing monetary expansion is the need for wages to grow above inflation. This possibility could materialize after the union-employer negotiations scheduled to conclude in March-April.

Fixed Government Income:

We adopt a cautious stance on duration risk in both Europe and the United States, preferring to focus on the short end of the yield curves. In Japan, we anticipate a significant rise in the 10-year bond yield within the next 3-6 months.

Equity:

With a positive macro outlook for the U.S. and Europe, we believe the value/cyclical segment (including European banks) may outperform the growth/defensive segment. Favoring European and Asian markets over North America due to relative valuation levels, we also find potential in the small-cap segment in the U.S., given macro strength expectations and the absence of further Fed interest rate hikes.

Credit:

While maintaining a preference for corporate fixed income, we acknowledge that spreads are not particularly wide. Combining credit exposure with well-selected positions in local currency emerging market debt is deemed sensible, offering good return prospects and lower risk that has historically been the case because many emerging countries benefit nowadays from strong economic governance, low public deficit, and controlled inflation.

Currencies:

We hold only moderate positions in dollars, anticipating a narrowing growth differential between the U.S. and Europe in 2024. Positive views are maintained on currencies like NOK, NZD, and AUD, as well as emerging market currencies with favorable macro governance and growth prospects (BRL, INR, MXN, IDR).

This report has been prepared by AMCHOR Investment Strategies SGIIC, S.A. (“AMCHOR IS”) an entity participated by the Alantra Group and incorporated as an investment firm authorized and supervised by the CNMV, registration number 273 with registered office at Calle Velázquez Nº 166, 28002 Madrid (Spain).

This report is addressed only to professional investors for internal and exclusive use. The information contained herein shall only be distributed as permitted by applicable law and AMCHOR IS and the Alantra Group specifically forbid the redistribution of this document in whole or in part without its prior written permission.

Nothing in this report constitutes a representation from AMCHOR IS or the Alantra Group that any investment strategy or recommendation contained herein is suitable or appropriate to a recipient’s individual circumstances or otherwise constitutes a personal recommendation. This report is published solely for information purposes, it does not constitute an advertisement and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments in any jurisdiction. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor it is intended to be a complete statement or summary of the securities or financial markets referred to in this report.

AMCHOR IS and the Alantra Group do not (i) endorse, guarantee nor represent that investors will obtain profits nor (ii) accept any liability for any investment that the recipients may carry out and incur in losses arising from adopting the recommendations included in this report or its contents. Investments involve risks and investors should exercise prudence in making their investment decisions. This information has been extracted from public sources that AMCHOR IS considers reliable and is not responsible for its truthfulness or accuracy. This report should not be regarded by recipients as a substitute for the exercise of their own judgement. Any opinions expressed in this report are subject to change. The analysis contained herein is based on numerous assumptions, hypothesis and forecasts. Different assumptions could result in materially different results. AMCHOR IS and the Alantra Group are under no obligation or keep current the information contained in this report.

The investor should note that the financial market is fluctuating and as such is subject to variations. The price of investments (which may be quoted in illiquid markets) may change and the investor may not get back the amount initially invested. The figures contained herein relate to the past. Past performance is not a reliable indicator of future results.