Macro Update – February 2023

Macro Update – February 2023

The majority of macro indicators continue to point in the ‘right’ direction and this has allowed for a very positive start of the year in both equities and bonds.

In the US, the recession risk continues to go down, with clear signs of moderation in price and wage pressures. In the last quarter of 2022, core inflation grew at an annualized rate of less than 3%, while the Employment Cost Index showed annualized growth of 4% over the same period – compared to 5.8% in the Spring of last year. In the eurozone, with economic activity showing signs of a slight rebound, the January inflation figure was also a welcomed surprise. In Asia, a strong economic rebound in China post-lockdown and a generally good performance across most Southeast Asian countries continues.

In addition to ongoing geopolitical risks, we believe there are additional factors to monitor in the coming months that could negatively impact the markets. In the US it is possible that, if financial conditions were to ease significantly, we could see a rebound in aggregate demand and therefore, renewed upward pressure on pricing and wages, forcing the Fed to become hawkish once more. In the Eurozone, with fiscal policy still very expansionary, there is a risk of wages increasing above 5%, which in turn, could keep European core inflation high. This would force the ECB to raise rates above what is currently discounted. In Asia, China’s relationship with the US will continue to play a part in wider economic outlooks.

Delving deeper, in the US, most macro indicators remain perfectly compatible with a scenario of inflation control without recession. For example:

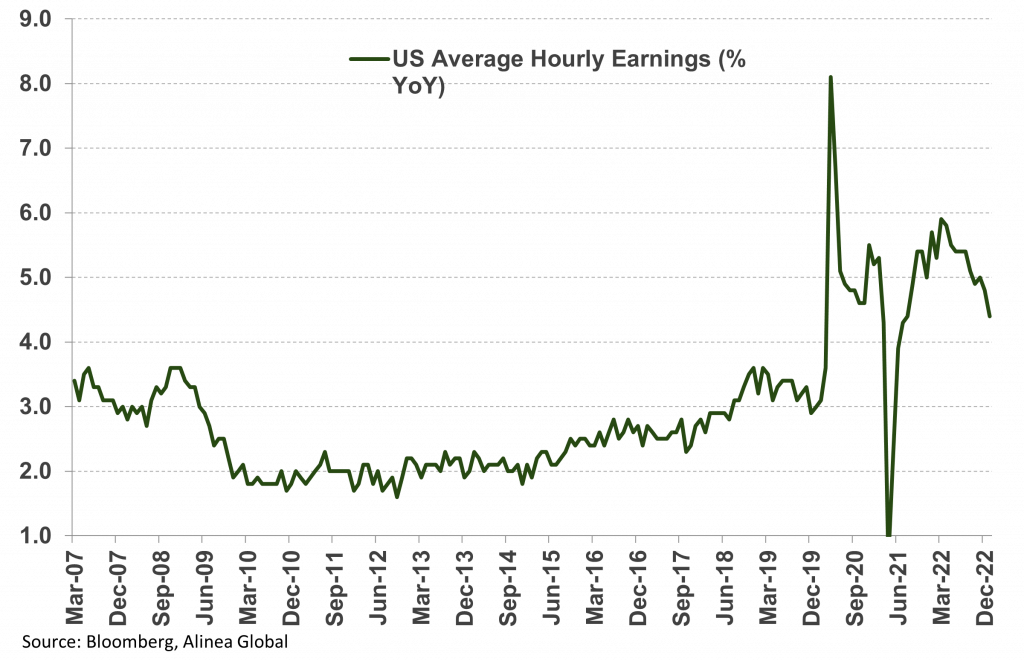

- Wages have been moderating for a few months, as illustrated by both the Average Hourly Earnings (AHE) and indicators such as the Employment Cost Index

Evolution of Average Hourly Earnings since 2007

- Medium-term inflation expectations linked to consumers and businesses remain reasonably anchored and, in the case of short-term inflation expectations (which have risen further), they have even begun to fall in recent weeks

- At the same time, low levels of layoffs and an extremely low unemployment rate (currently at 1969 levels) do not seem at all compatible with an imminent recession. However, if the participation rate confirms its recent recovery, this would be a positive outcome, as the US economy could then grow further without necessarily triggering excessive inflationary pressures

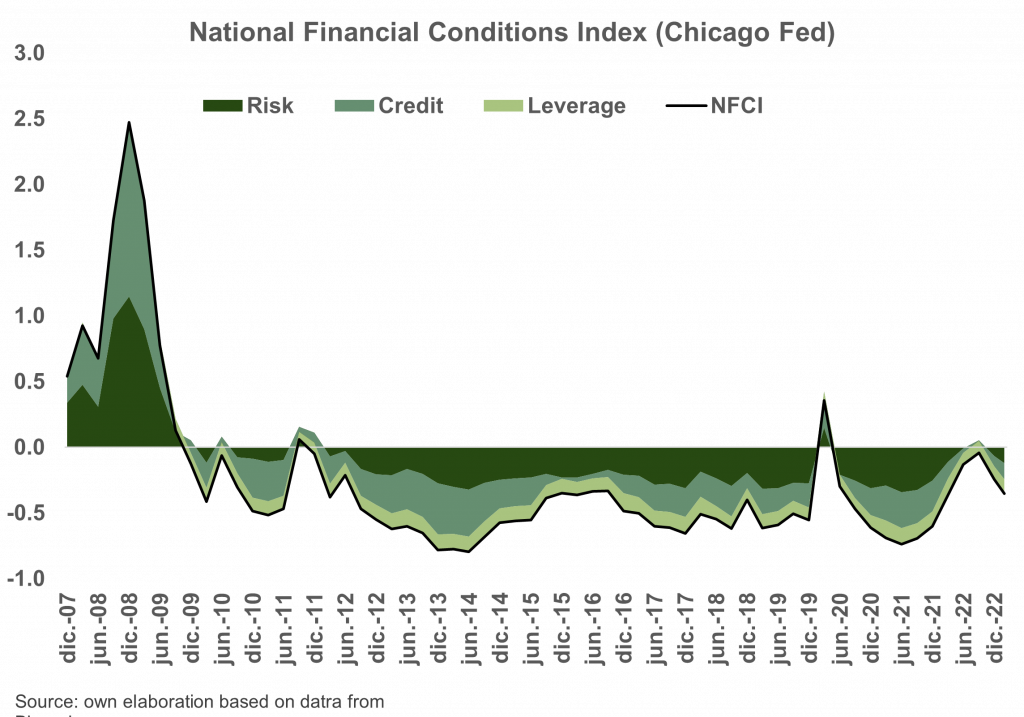

Taking the above into account, we believe that the main risk for the US economy in the short-term is not a recession, but rather a potential reacceleration in aggregate demand and inflationary pressures if financial conditions were to ease too much1.

Chicago Fed National Financial Conditions Index

The relative stabilisation shown in recent weeks by the real estate sector (perhaps the most sensitive to interest rate levels) could be a sign that interest rates may not have much room to fall without generating a potentially untimely economic upturn.

In the Eurozone, activity data is clearly not pointing to the recession most markets have been braced for.

At the same time, while core inflation continues to pick up, prices may also be starting to ease. Headline inflation is falling rapidly, and consumer and business price expectations have moderated in the recent period.

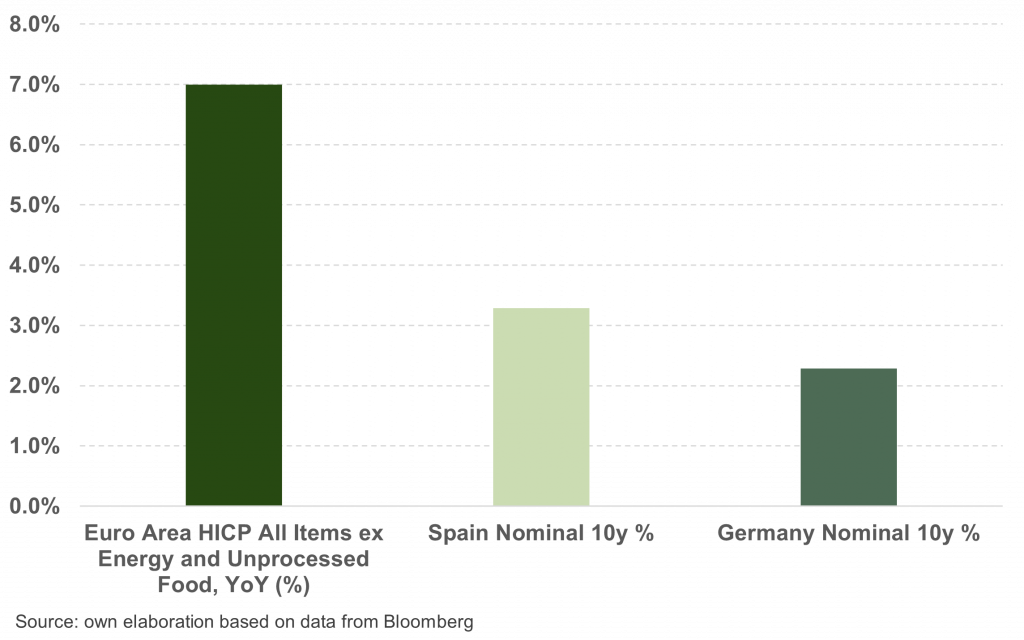

In our opinion, the biggest risk to the Eurozone is that we have three things going on at the same time: a positive output gap, a very expansionary fiscal policy, and a process of wage acceleration that is clearly underway but whose peak is not yet known. Combined, these factors could generate persistence in core inflation and force the ECB to raise rates significantly above what is now discounted. If this happens, the risks of recession in Europe for the second half of 2023 would increase significantly and scenarios of tension in peripheral debt could not be ruled out.

Growth of Consumer Prices in the Euro Area

In Asia, it seems increasingly clear that China will have a strong recovery post-COVID lockdowns, and that most countries of Southeast Asia also have very favorable growth prospects for 2023 – the latter being economies that enjoy a high degree of macroeconomic stability, such as relatively low inflation, controlled levels of public deficit, good external balance, and ample foreign exchange reserves.

Our market view remains the same as the last few months:

Government bonds: We see curves in the US and Europe as being fairly priced, but at the same time we continue to bet on short durations as we see more upside than downside risks to interest rates. In particular, we would avoid the long end of curves which could be affected by an eventual upward revision of neutral rate estimates by central banks. On the other hand, we believe that Japan will be forced to ease its yield curve control policy again in the coming months, especially if wages start to grow above 3% from Spring onwards – the latter seeming increasingly likely.

Credit: In our opinion, corporate bonds with short durations remain preferable but, given the contraction already seen in spreads, we see more and more opportunity in combining this asset with carefully selected local currency emerging government bond exposures.

Equities: We believe European and Asian equities may be favourable to US equities, as we see very little valuation headroom in the latter. At the same time, the resilience of economic activity in Europe and the US leads us to believe that interest rates will remain high for longer than the market expects. In that sense, we prefer an underweight exposure to the growth segments of the markets, although perhaps some exposure to the smaller companies’ segment in the US and Europe – which offers attractive valuations in relative terms – could do well in a soft-landing scenario.

Currencies: Dollar levels around 1.10 (or even better 1.12, if it comes) seem attractive enough to make this currency a good hedge for Euro investors. Otherwise, if a soft-landing in the US is confirmed, emerging market currencies from countries with good macro governance may also be a good idea.

Hedging strategies: In addition to cash (now much better remunerated), hedging strategies that do not depend on duration and that can do well in environments of market volatility and inflation persistence still have a role to play in portfolios.

Álvaro Sanmartín Antelo, Partner and Chief Economist at AMCHOR Investment Strategies.

Alantra holds a strategic stake in AMCHOR IS, an independent product specialist that selects best-in-class international asset management firms and structures alternative investment funds for distribution to Spanish, Italian, and Portuguese investors. Founded in 2008, AMCHOR currently represents or manages more than €5bn AuM.

1Although it is true that, due to the lags with which monetary policy normally acts, some of the contractionary effects of rate hikes on the real economy may still be to come, we believe that most of these effects have already been felt, not least because for many months now the US 10-year yield has tended to be above 3%.

This report has been prepared by AMCHOR Investment Strategies SGIIC, S.A. (“AMCHOR IS”) an entity participated by the Alantra Group and incorporated as an investment firm authorized and supervised by the CNMV, registration number 273 with registered office at Calle Velázquez Nº 166, 28002 Madrid (Spain).

This report is addressed only to professional investors for internal and exclusive use. The information contained herein shall only be distributed as permitted by applicable law and AMCHOR IS and the Alantra Group specifically forbid the redistribution of this document in whole or in part without its prior written permission.

Nothing in this report constitutes a representation from AMCHOR IS or the Alantra Group that any investment strategy or recommendation contained herein is suitable or appropriate to a recipient’s individual circumstances or otherwise constitutes a personal recommendation. This report is published solely for information purposes, it does not constitute an advertisement and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments in any jurisdiction. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor it is intended to be a complete statement or summary of the securities or financial markets referred to in this report.

AMCHOR IS and the Alantra Group do not (i) endorse, guarantee nor represent that investors will obtain profits nor (ii) accept any liability for any investment that the recipients may carry out and incur in losses arising from adopting the recommendations included in this report or its contents. Investments involve risks and investors should exercise prudence in making their investment decisions. This information has been extracted from public sources that AMCHOR IS considers reliable and is not responsible for its truthfulness or accuracy. This report should not be regarded by recipients as a substitute for the exercise of their own judgement. Any opinions expressed in this report are subject to change. The analysis contained herein is based on numerous assumptions, hypothesis and forecasts. Different assumptions could result in materially different results. AMCHOR IS and the Alantra Group are under no obligation or keep current the information contained in this report.

The investor should note that the financial market is fluctuating and as such is subject to variations. The price of investments (which may be quoted in illiquid markets) may change and the investor may not get back the amount initially invested. The figures contained herein relate to the past. Past performance is not a reliable indicator of future results.