Macro Update – December 2023

Macro Update – December 2023

Recent data on activity and prices align with our central scenario:

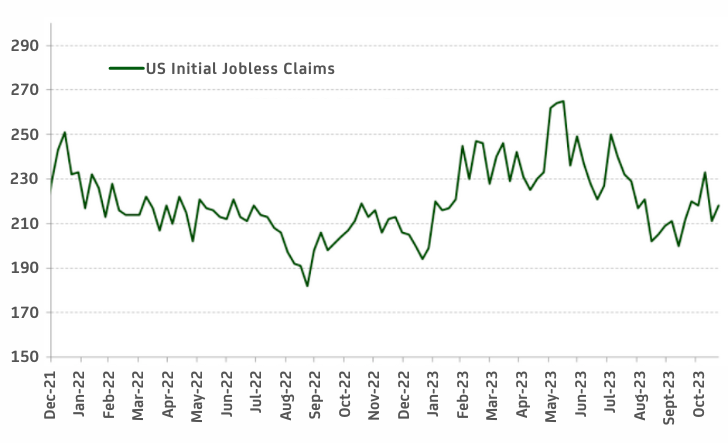

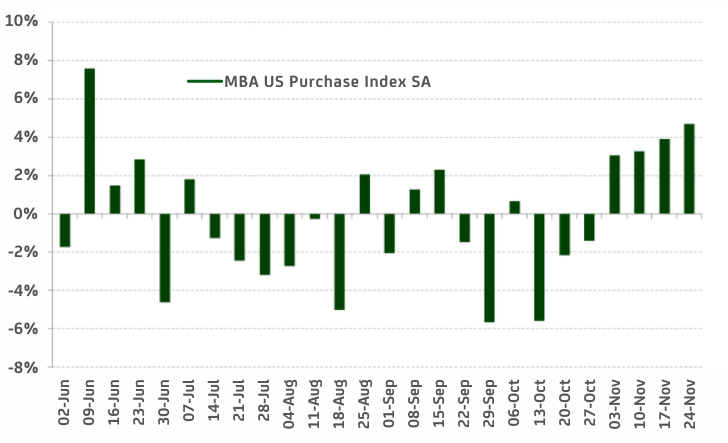

- The United States is slowing moderately, with growth rates expected to be in line with or slightly below potential.

- Economic activity in the Eurozone continues to stabilize, particularly in the context of a still quite robust labor market.

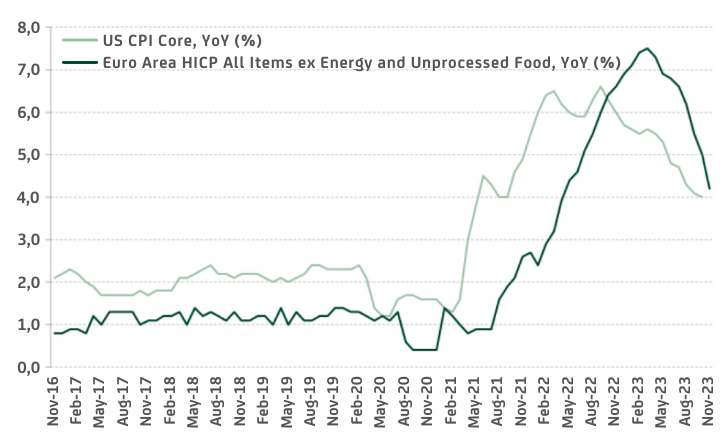

- Underlying inflation is notably decreasing on both sides of the Atlantic.

- Central banks, with increasing emphasis, reiterate their commitment not to raise interest rates any further in this cycle and even begin talking about rate cuts (with the Fed becoming a touch too dovish in our view).

- Despite prevailing negative sentiment, China continues to target growth rates slightly above 5% for 2023 and possibly 2024.

- The Japanese labor market shows signs of strength, setting a favorable backdrop for wage negotiations early next year.

Given the favorable environment for risk assets, portfolio positions should reflect this sentiment. However, to avoid complacency, we will closely monitor three main risk sources: potential oil price rebounds affecting inflation expectations, concerns about the sustainability of public debt in some economies, and evolution of financial conditions (with respect to the latter, if financial conditions ease too much too soon that could put the disinflation process in danger during 2024). Additionally, we will pay attention to the evolution of fiscal policy in Germany following the decision of the country’s courts to limit the “extra-budgetary” use of certain funds left unused after the pandemic.

As the fundamental elements of our central scenario remain unchanged, this month’s letter will focus on highlighting those aspects that we consider more relevant in understanding how the macroeconomic and market environment will evolve in the coming months. Let’s delve into it.

First idea

Unless financial conditions become overly relaxed, U.S. growth will likely tend to moderate in the coming months, reaching rates in line with or slightly below potential. Despite this, we still see underlying strength and maintain a low probability of a short-term recession in the American economy.

Second idea

Macro data in the Eurozone continues to show signs of stabilization, paving the way, in our opinion, for growth above 1% during 2024. The factors supporting this forecast have been extensively described in previous months and are primarily related to the strong fundamentals of private consumption, the low real interest rates, and the anticipated end of the downward inventory adjustment by the European industry. This adjustment has significantly weighed on this segment of activity for quite some time and this may well change in the course of 2024.

Third idea

Looking ahead, underlying inflation should continue to fall significantly both in the U.S. and the Eurozone, provided that financial conditions remain sufficiently restrictive for a long enough period.

Fourth idea

Unless there are unexpected increases in inflation, we will not see any more interest rate hikes in this cycle from either the Fed or the ECB. That being said, and in line with the comments above, we believe that it is essential for monetary authorities to exercise particular caution in their communication from now on to prevent financial markets from persistently pricing in too many rate cuts over the next 12 months.

Sovereign Bonds:

In November, yield curves in the U.S. and the Eurozone corrected a significant portion of the strong upward movement they had experienced since summer. In our view, there is little room for medium and long-term yields to fall appreciably from their levels in early December. If they were to do so, it could lead to an excessively relaxed financial environment, posing the risk of reactivating inflationary pressures. In this context, we prefer to focus on the short end of the yield curves, both in the U.S. and, more distinctly, in the Eurozone. Regarding Japan, we maintain our forecast that the yield on 10-year bonds is likely to rise significantly in the next 6-9 months.

Equity:

Given our expectation that the macroeconomies in the U.S. and Europe will avoid a recession and our belief that real interest rates will remain reasonably high structurally, we continue to believe that the value and above all cyclical segment of the market (including European banks) should outperform the growth/defensive segment. Geographically, we prefer European and Asian markets over the U.S., considering both the aforementioned factors and relative valuation levels.

Credit:

We continue to favor corporate bonds as, in our central macroeconomic scenario, default rates should not increase significantly. Although spreads are not particularly high, we believe it makes sense to combine credit exposure with well-selected positions in emerging market local currency debt. The latter asset class attracts us for two main reasons: firstly, it offers very good return prospects, especially in terms of carry, and possibly also due to potential currency appreciation; secondly, certain emerging market countries with expected high relative growth rates also benefit from solid economic governance, low public deficits, and reasonably controlled inflation. In our opinion, these characteristics make exposure to local currency debt in these countries less risky than it might seem at first glance.

Currencies:

We maintain a relatively cautious view on the U.S. dollar as we believe the growth differential between the U.S. and Europe will narrow significantly in 2024. Simultaneously, we hold a positive view on currencies such as NOK, NZD, GBP or AUD; and we continue to favor currencies of emerging markets with good macroeconomic governance and favorable growth prospects (BRL, INR, MXN, IDR). Additionally, considering the positive macroeconomic signals from Japan, we believe the yen (in prudent amounts) could be a good defensive position for the coming months.

This report has been prepared by AMCHOR Investment Strategies SGIIC, S.A. (“AMCHOR IS”) an entity participated by the Alantra Group and incorporated as an investment firm authorized and supervised by the CNMV, registration number 273 with registered office at Calle Velázquez Nº 166, 28002 Madrid (Spain).

This report is addressed only to professional investors for internal and exclusive use. The information contained herein shall only be distributed as permitted by applicable law and AMCHOR IS and the Alantra Group specifically forbid the redistribution of this document in whole or in part without its prior written permission.

Nothing in this report constitutes a representation from AMCHOR IS or the Alantra Group that any investment strategy or recommendation contained herein is suitable or appropriate to a recipient’s individual circumstances or otherwise constitutes a personal recommendation. This report is published solely for information purposes, it does not constitute an advertisement and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments in any jurisdiction. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor it is intended to be a complete statement or summary of the securities or financial markets referred to in this report.

AMCHOR IS and the Alantra Group do not (i) endorse, guarantee nor represent that investors will obtain profits nor (ii) accept any liability for any investment that the recipients may carry out and incur in losses arising from adopting the recommendations included in this report or its contents. Investments involve risks and investors should exercise prudence in making their investment decisions. This information has been extracted from public sources that AMCHOR IS considers reliable and is not responsible for its truthfulness or accuracy. This report should not be regarded by recipients as a substitute for the exercise of their own judgement. Any opinions expressed in this report are subject to change. The analysis contained herein is based on numerous assumptions, hypothesis and forecasts. Different assumptions could result in materially different results. AMCHOR IS and the Alantra Group are under no obligation or keep current the information contained in this report.

The investor should note that the financial market is fluctuating and as such is subject to variations. The price of investments (which may be quoted in illiquid markets) may change and the investor may not get back the amount initially invested. The figures contained herein relate to the past. Past performance is not a reliable indicator of future results.