Macro Update – April 2025

Macro Update – April 2025

Trump’s unexpected escalation of reciprocal tariffs — initially well above market expectations — triggered a sharp correction across global financial markets. However, facing rising domestic bond market volatility, the U.S. administration abruptly reversed course on April 9, announcing a 90-day pause on the most recent tariff hikes, with the notable exception of China. Tariffs now stand at an interim rate of 10%.

This policy shift reveals the White House’s tolerance threshold for market stress and may signal the formation of a tentative bottom in risk assets. In the near term, we expect less volatility and a greater degree of asset class discrimination from markets.

What does this mean in practice?

- Equities are likely to rebound in the coming weeks, but we maintain the view that even this moderated tariff policy remains structurally negative for U.S. growth. Accordingly, we see continued underperformance of U.S. equities relative to other markets.

- Tariffs at 10% are clearly less damaging than 22%, but they are still inflationary for the U.S. while exerting disinflationary pressure abroad. In this context, we see limited justification for the recent upward movement in long-end yields across non-U.S. government curves.

- Despite recent USD weakness, the sharp underperformance of “well-behaved” currencies (those backed by credible fiscal paths, solid growth, and declining inflation) appears overdone, and we expect a partial reversal of those moves.

Note: The following part of the analysis was written prior to Trump’s April 9 announcement, but we decided to include it as is, as a stress-test scenario in case tariff escalation resumes.

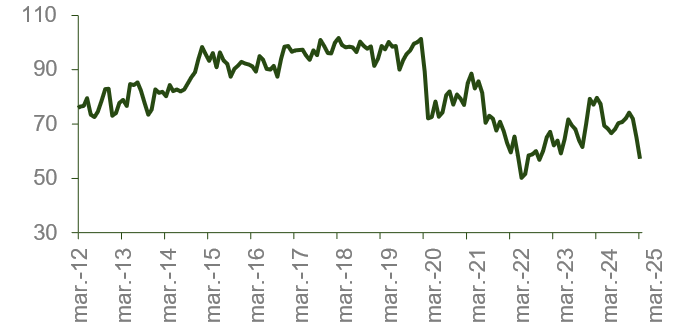

The uncertainty shock created by the tariffs, even before implementation, has had a particularly severe impact on sentiment indicators in the United States :

Consumer Trust (U. Michigan)

In addition, tariff-induced inflation pressure in the U.S. will further constrain the Fed’s ability to cut rates pre-emptively. We expect further deterioration in both consumer and business confidence as inflation data increasingly validates the price pressures stemming from the tariffs.

Outside the U.S., the primary channel of transmission from tariffs will be a negative demand shock, particularly affecting exporters with exposure to U.S. markets.

This will have a disinflationary effect globally:

Eurozone Services Inflation Expectations

This global disinflation opens the door for greater monetary policy flexibility outside the U.S. We expect the ECB to cut rates at its April 17 meeting. Similar accommodation is likely across other central banks, particularly where inflation is not a primary concern.

In China, the response to U.S. tariffs has been more selective — targeted solely at the U.S. rather than globally. With deflation still a larger concern than inflation, the People’s Bank of China is expected to cut reserve requirements substantially this month to support domestic demand.

Fiscal policy effects are expected to diverge meaningfully:

- In the U.S., tariff-related tax hikes and public spending cuts are set to be fiscally contractionary.

- Elsewhere, fiscal stances remain neutral to expansionary, with China and Germany expected to roll out significant stimulus programs.

- This divergence reinforces our view that the medium-term outlook is relatively more challenging for the U.S., potentially incentivizing further de-escalation from the White House later this year.

Trade War Scenario Going Forward

While we do not anticipate an immediate resolution, we believe the likely endgame involves tariffs stabilizing around 10% on average, with China possibly facing higher rates. Such a regime, while far from ideal, could be manageable for the global economy and might help calm financial markets and generate modest U.S. fiscal revenues to offset planned tax cuts in 2026.

Market Outlook & Asset Allocation

Our asset allocation framework rests on the following views:

- Risk assets, particularly non-U.S. equities, have room to re-rate higher over a 6–12-month horizon if our base case unfolds.

- In the event of a deeper global slowdown from prolonged trade conflict, long-duration sovereign bonds (especially in fiscally sound economies with limited stimulus risk) offer strong hedging potential.

- While recent underperformance has called its hedging role into question, the Japanese yen continues to serve as an effective risk-off hedge. Japan’s reflation story remains intact, and pressure from the U.S. to appreciate the yen could add further support.

- We continue to favor a diversified currency basket, excluding the USD, with a focus on currencies backed by solid macro fundamentals and likely to remain outside the trade conflict crossfire.

This report has been prepared by AMCHOR Investment Strategies SGIIC, S.A. (“AMCHOR IS”) an entity participated by the Alantra Group and incorporated as an investment firm authorized and supervised by the CNMV, registration number 273 with registered office at Calle Velázquez Nº 166, 28002 Madrid (Spain).

This report is addressed only to professional investors for internal and exclusive use. The information contained herein shall only be distributed as permitted by applicable law and AMCHOR IS and the Alantra Group specifically forbid the redistribution of this document in whole or in part without its prior written permission.

Nothing in this report constitutes a representation from AMCHOR IS or the Alantra Group that any investment strategy or recommendation contained herein is suitable or appropriate to a recipient’s individual circumstances or otherwise constitutes a personal recommendation. This report is published solely for information purposes, it does not constitute an advertisement and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments in any jurisdiction. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor it is intended to be a complete statement or summary of the securities or financial markets referred to in this report.

AMCHOR IS and the Alantra Group do not (i) endorse, guarantee nor represent that investors will obtain profits nor (ii) accept any liability for any investment that the recipients may carry out and incur in losses arising from adopting the recommendations included in this report or its contents. Investments involve risks and investors should exercise prudence in making their investment decisions. This information has been extracted from public sources that AMCHOR IS considers reliable and is not responsible for its truthfulness or accuracy. This report should not be regarded by recipients as a substitute for the exercise of their own judgement. Any opinions expressed in this report are subject to change. The analysis contained herein is based on numerous assumptions, hypothesis and forecasts. Different assumptions could result in materially different results. AMCHOR IS and the Alantra Group are under no obligation or keep current the information contained in this report.

The investor should note that the financial market is fluctuating and as such is subject to variations. The price of investments (which may be quoted in illiquid markets) may change and the investor may not get back the amount initially invested. The figures contained herein relate to the past. Past performance is not a reliable indicator of future results.