Macro Update – April 2023

Macro Update – April 2023

In light of the turmoil witnessed in the banking sector in recent weeks, it is conceivable that financial conditions could tighten sufficiently to generate a recession in the U.S. and/or Europe.

However, do we believe this is likely to happen? No, we do not – for two key reasons:

Firstly, the current situation presents a solid foundation unlike that which prevailed at the dawn of the international financial crisis. At present, banks are far better capitalized and have much higher liquidity ratios; household and non-financial corporate balance sheets are much stronger; and there is an absence of relevant supply-side imbalances in the real economy.

Secondly, authorities today not only have a wider arsenal of liquidity management tools than in 2008, but the ability to use them is also significantly greater. Amid this backdrop, and although accidents can certainly not be ruled out, our main scenario for the U.S. and the Eurozone remains basically the same – interest rates will remain moderately high for quite some time yet, and this will allow inflation to be controlled without generating a recession.

In more concrete terms, what we consider most likely for the US economy is that the Fed interest rates will remain at their current level (or perhaps 25bp higher) until at least the end of the year; wages and core inflation will confirm a path of progressive moderation; and positive economic growth will prevail, albeit possibly somewhat below potential.

In the Eurozone, we expect three things to occur for the remainder of the year. Firstly, as falling commodity prices, accelerating wage growth, and strong fiscal expansion act as tailwinds for aggregate demand, we believe that the European Central Bank (ECB) will be forced to raise rates in two more occasions and then leave them at that terminal level for quite some time. Secondly, this moderately tight monetary policy by the ECB, coupled with well-anchored inflation expectations, will help core inflation to peak before the summer. Thirdly, growth will remain in clearly positive territory and perhaps close to potential for 2023 as a whole.

Outside the U.S. and Europe, we continue to believe that Asia’s emerging markets will see by far the strongest economic growth this year, with China rebounding strongly after the abandonment of the Covid zero policy, and India and Southeast Asia also showing a clearly favorable outlook. Simultaneously, we continue to believe that the Bank of Japan (BOJ) – due to the strong progress made by the country in terms of accelerating wages and underlying prices – will soon be able to ease its yield curve control policy.

No one today knows for certain how much credit conditions will tighten due to recent (and possible future) events with banks. For that reason, over the next few weeks it is important to pay particular attention to variables, fundamentally those of financial nature, that can help us detect possible sources of tension (movements in bank deposits, use of central banks liquidity facilities, corporate bond spreads, credit granting conditions by banks, volatility levels in markets etc.).

That said, and as noted above, we believe it is most likely that this episode will be overcome without major damage. Assuming that this is indeed the case, in this Macro Update we will specify our expectations for the global economy for the remainder of the year.

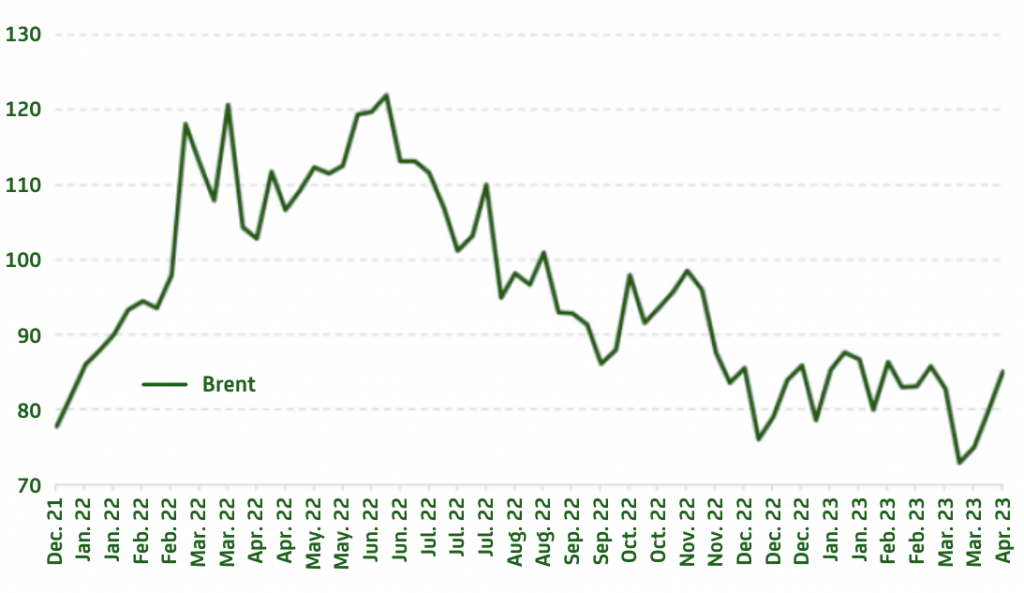

Starting in the U.S., the basic elements of our core scenario can be summarized as follows: despite the recent rebound in crude oil prices following OPEC’s latest production cut decision, the fall in commodity prices from last year’s highs will allow for a relatively rapid decline in headline inflation in the coming months.

Fluctuations in commodity prices

In addition, interest rates maintained at their current level (or 25bp above) for a sufficiently long period of time will probably be sufficient to achieve a gradual correction of the excess demand that has characterized the US economy for quite some time now.

The lower excess demand, the expected fall in headline inflation and well-anchored inflation expectations will also help wages to confirm the moderation path that began in the first months of 2022.

At the same time this wage moderation, together with the fall in commodity prices, and once again well-anchored inflation expectations should lead to reasonably prudent pricing strategies by companies over the coming quarters. If we add to this the fact that, sooner rather than later, the significant moderation in residential rental prices, which has been observed for some time now from private sources should start to be reflected in official statistics as well, we believe that U.S. core inflation will moderate further, and possibly a little more rapidly than what has been the case recently, over the coming months.

Finally, against those who believe that controlling inflation in the U.S. will inevitably lead to a difficult recession, we continue to think that the U.S. economy will manage to overcome the current period of strong price pressures by maintaining moderately positive economic growth. In turn, this relatively benign view of how the U.S. economy is likely to perform in the coming quarters is mainly supported by two elements. The first is that reasonably well-anchored price expectations mean that a moderately contractionary monetary policy can be sufficient to control inflation. The second is that the economy does not have large imbalances and, therefore, is less prone to ‘accidents’ than was the case at other times in history.

As far as the Eurozone is concerned, our main scenario for the remainder of the year can be summarized as follows:

Firstly, the fall in commodity prices compared to last year, the strong fiscal expansion, and the acceleration in wages are significant tailwinds for aggregate demand, and thus, make it almost inevitable that the ECB will be forced to raise the deposit rate further (perhaps to 3.5%) and hold it at that level for a sufficiently long period of time. Our impression that the Eurozone still needs further rate hikes to control inflation is further reinforced by the fact that unemployment in the Eurozone is at record lows, which is in turn compatible with an output gap clearly in positive territory.

Secondly, the ECB’s tight monetary policy will help to moderate aggregate demand in the second half of the year, and this circumstance, together with the fact that inflation expectations remain well anchored in Europe as well, will make it possible for wage growth (albeit dynamic) to remain within reasonable limits thus, avoiding generating excessively harmful second-round effects.

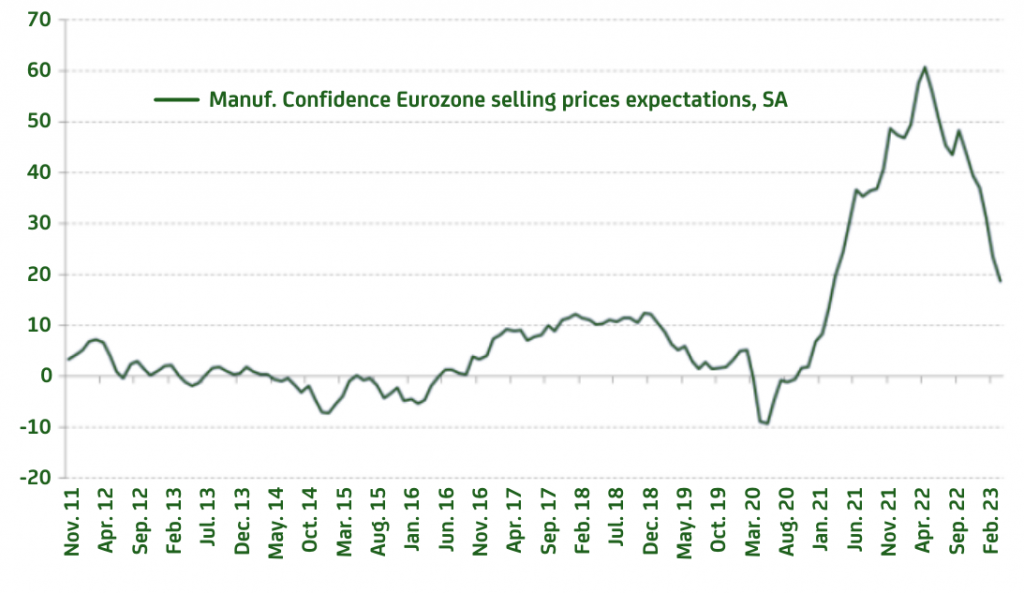

Thirdly, in line with what we previously commented about the US, the same factors that lead us to expect a reasonable wage behavior in the Eurozone, also make pricing policies likely to be sufficiently prudent by European companies. We therefore believe that core inflation in the Eurozone could peak before the Summer.

Selling prices expectations in the Eurozone

Fourth, in a context such as the one described thus far (fiscal policy still significantly expansionary, lower commodity prices, rising wages etc.), we believe that economic growth in the Eurozone in 2023 will remain in clearly positive territory (and perhaps at rates close to potential).

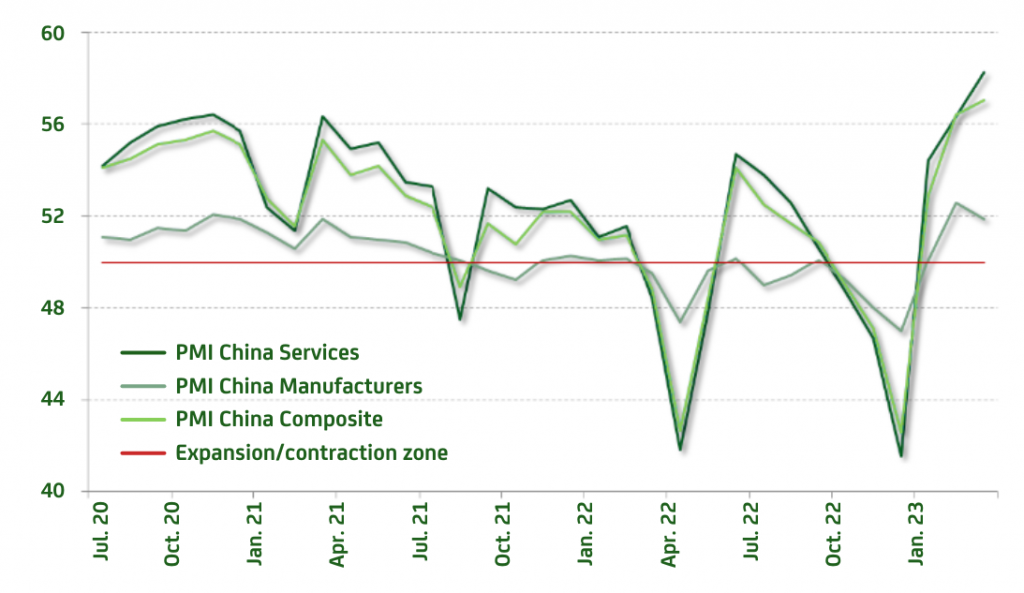

With regards to China, most recent macro data point to a significant rebound in activity (services PMI at 12-year highs), with the real estate sector also starting to show signs of some stabilization (home sales, for example, have rebounded for two consecutive months).

Evolution of PMI

At the same time, India and Southeast Asia present, in our opinion, a clearly positive outlook for the year as a whole.

In the case of Japan, most macro data continue to point in the right direction. On the one hand, economic activity has improved further (for example, the latest services PMI was at a nine year high). On the other, both underlying prices and wages have been showing increasing dynamism (regarding the latter, it is noteworthy that the recent agreement between employers and unions set average wage increases of 3.8% for the current year, well above what was achieved in previous years and clearly higher than what the market was expecting). In this context, we continue to believe that the BOJ will opt to relax its yield curve control policy in the coming months.

On the risk side, outside of the macro and geopolitical issues regularly discussed (war in Ukraine, US-China tensions, the US debt ceiling, tensions in the banking system, etc.), we will also monitor the possibility of central banks halting rate hikes too soon or being tempted to lower rates prematurely. Should this happen (and we hope this isn’t the case), the subsequent sequence of events could be as follows: a pickup in aggregate demand and, with it, price pressures; possible de-anchoring of inflation expectations; and then central banks forced to conduct very restrictive monetary policies, which would make a scenario of significant recession almost inevitable. In relation to the above, we will also have to keep a close eye on the impact on energy prices of the recent OPEC’s decision to cut crude oil production.

Market perspective

Reviewing the current market, our perspective can be summarized as follows:

- Government fixed income: unless the situation of the banking system becomes much more complex than we are expecting, we believe that interest rates will remain relatively high for longer than currently discounted by the markets. As a result, we once again see very little value in duration risk, both in Europe and in the United States. Meanwhile, in the case of Japan, we continue to believe the BOJ will be forced to abandon its yield curve control policy sooner rather than later and that this justifies short positions in the Japanese 10-year bond.

- Credit: we continue to favor corporate bonds because in our main macro scenario default rates should not increase too much. But we also believe it makes sense to combine credit exposure with well-selected positions in emerging government bonds in local currency. The latter asset class appeals to us for two main reasons: firstly, because it has very good return prospects – both in terms of carry and potential exchange rate appreciation. Secondly, because there is currently a group of emerging countries for which we expect high relative growth rates and which also benefit from sound economic governance, low public deficits, and inflation rates reasonably well under control (these characteristics make exposure to local currency debt of these countries less risky than it might appear at first glance)

- Equities: as we see upward shifts in interest rate curves between now and the end of the year, we think that the value/cyclical segment of the market (including banks) will again do better than the growth/defensive segment. Geographically, considering the above as well as the relative valuation levels, we find the European and emerging Asian markets more attractive than their US counterpart

- Currencies: dollar levels in the vicinity of 1.10 (or even better 1.12) would be attractive enough to make this currency a strong hedge for euro investors. At the same time, and in view of the good signals that Japan is generating, we believe that the yen could be in a good hedge position for the remainder of the year as well. We also have a constructive stance on the pound, and we continue to favor emerging market currencies from countries with good macro governance

Álvaro Sanmartín Antelo, Partner and Chief Economist at AMCHOR Investment Strategies.

Alantra holds a strategic stake in AMCHOR IS, an independent product specialist that selects best-in-class international asset management firms and structures alternative investment funds for distribution to Spanish, Italian, and Portuguese investors. Founded in 2008, AMCHOR currently represents or manages more than €5bn AuM.

This report has been prepared by AMCHOR Investment Strategies SGIIC, S.A. (“AMCHOR IS”) an entity participated by the Alantra Group and incorporated as an investment firm authorized and supervised by the CNMV, registration number 273 with registered office at Calle Velázquez Nº 166, 28002 Madrid (Spain).

This report is addressed only to professional investors for internal and exclusive use. The information contained herein shall only be distributed as permitted by applicable law and AMCHOR IS and the Alantra Group specifically forbid the redistribution of this document in whole or in part without its prior written permission.

Nothing in this report constitutes a representation from AMCHOR IS or the Alantra Group that any investment strategy or recommendation contained herein is suitable or appropriate to a recipient’s individual circumstances or otherwise constitutes a personal recommendation. This report is published solely for information purposes, it does not constitute an advertisement and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments in any jurisdiction. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor it is intended to be a complete statement or summary of the securities or financial markets referred to in this report.

AMCHOR IS and the Alantra Group do not (i) endorse, guarantee nor represent that investors will obtain profits nor (ii) accept any liability for any investment that the recipients may carry out and incur in losses arising from adopting the recommendations included in this report or its contents. Investments involve risks and investors should exercise prudence in making their investment decisions. This information has been extracted from public sources that AMCHOR IS considers reliable and is not responsible for its truthfulness or accuracy. This report should not be regarded by recipients as a substitute for the exercise of their own judgement. Any opinions expressed in this report are subject to change. The analysis contained herein is based on numerous assumptions, hypothesis and forecasts. Different assumptions could result in materially different results. AMCHOR IS and the Alantra Group are under no obligation or keep current the information contained in this report.

The investor should note that the financial market is fluctuating and as such is subject to variations. The price of investments (which may be quoted in illiquid markets) may change and the investor may not get back the amount initially invested. The figures contained herein relate to the past. Past performance is not a reliable indicator of future results.