Facing into the cost of funding headwinds

Facing into the cost of funding headwinds

Banking Market Update

The current macroeconomic climate has created a challenging environment for all lenders, with the impacts felt in lower lending volumes, higher costs of funding and cost inflation, among others – from non-bank lenders to FinTech, to traditional banks. Further, the dislocation seen in both private and public market valuations has impacted the ability of many lenders to optimally raise equity.

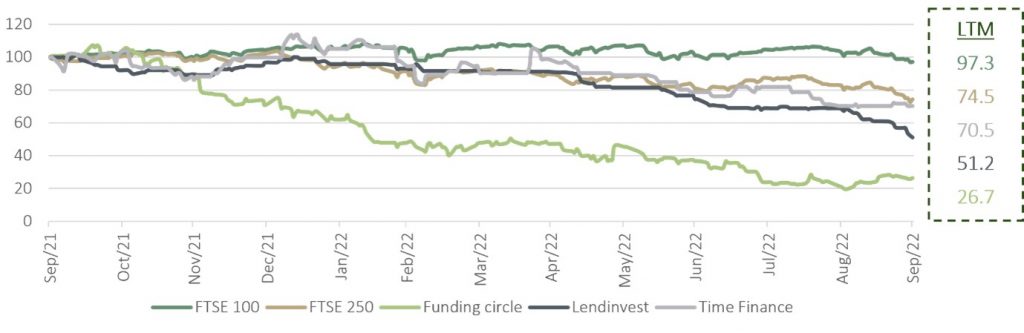

UK equity rebased to 100, between Q4 ‘21 and Q3 ‘22 [1]

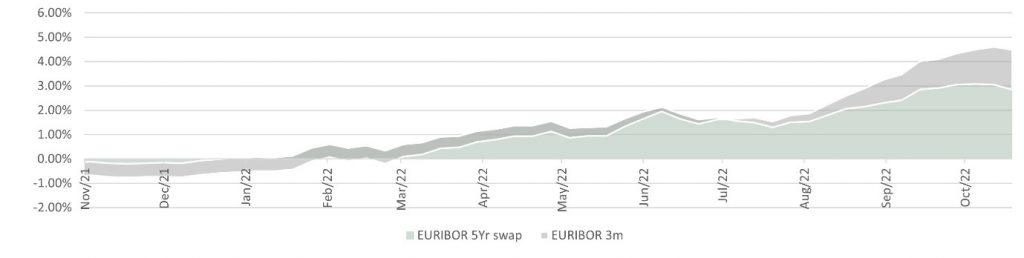

For non-bank lenders, rising benchmark rates and wider credit spreads have materially increased funding costs, resulting in a significant increase in rates and the devaluation of unhedged loans and borrower offers.

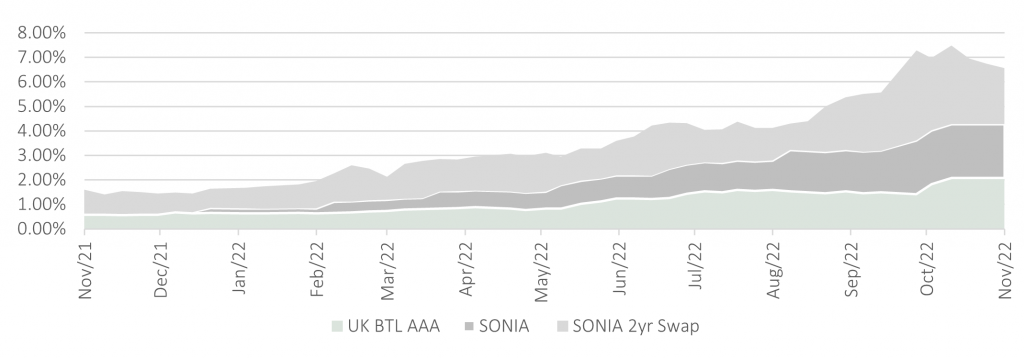

Evolution of securitization funding in the UK – last twelve months [2]

So how can the industry face these significant headwinds?

Offsetting funding cost increases

Non-bank lenders are experiencing a seismic shift on the back of current economic instability and the rising cost of funding. Warehouse financing and term refinancing through securitisation markets have become less attractive – whether it be higher margins, lower advance rates, stricter eligibility criteria. This funding source has become less rewarding for many who have traditionally operated in this space.

As such, as an alternative to a warehouse-to-securitisation funding model, many platforms are considering implementing forward flow structures – where an acquiring partner provides effectively all the funding for a loan, thereby reducing the capital required by originator to originate that loan. Compellingly, rather than waiting for net interest margin and cost synergies at point of securitisation, a lender is thus able to ‘pull forward’ profit at the time of issuing the loan and so, generate valuable liquidity that could help protect margins and profitability.

This funding model shift has become of particular interest to relatively new lenders, who have comparatively smaller loan books to absorb rising platform and funding costs. Meanwhile, many funders and asset purchasers continue to demonstrate appetite to establish longer-term partnerships with high quality originators. For example, although traditional banks’ funding costs have also increased, this has been at a much slower rate than the public funding market, and thus many banks are now stepping into provide funding for a non-bank lenders that will provide a differentiated origination channel.

Evolution of European Bank funding costs – last twelve months

In addition, larger lenders who are well capitalised also see opportunity in the current market to acquire new capabilities through strategic acquisitions. A recent example of this is Elliott Advisor’s acquisition of Enra, which expands Elliot’s ability to lend to UK customers. In such circumstances, lenders not only benefit from an injection of capital to help drive origination volumes and net interest margin, but also form a long-term partnership that provides a firmer footing to build enterprise value in the years to come.

Building (or buying) a current account capability

For traditional banks, the current cost of lending has triggered a re-assessing of the accounts they offer their customers. Traditionally, current accounts have been more difficult to run, as they need additional IT infrastructure and regulatory and risk assessments, as systems must be able to respond real time to direct debits and transactions.

However, in the current funding cost environment there are huge benefits for banks to offer current accounts over saving accounts. Loans that are written with current accounts have traditionally had good margins and the current account interest rate in the UK, for example, is still close to 0%. Therefore, any bank that offers current accounts generally has a lower cost of funding.

As funding costs with saving accounts increase – with account costs growing 1-2% – those that offer saving accounts only are now at a disadvantage, impacting net interest margin and competitiveness in prime lending niches.

As in the public funding market, for those larger banks that have built business models around saving accounts, acquiring a smaller current account player or a specific technology that would allow for an easy transition, may be the answer. However, opportunities to acquire current account capabilities are few. There are a limited number of players that are well suited to an acquisition, and those that are, may come at a high valuation. That said, for the right buyer, this may provide an opportunity for growth and potentially, entrance into new markets and technologies that would otherwise take excessive time and cost to build in-house.

For banks with assets below EUR / GBP 5BN, the cost-benefit analysis of buying or building current account capability combined with punitive MREL rules for banks with over 40,000 transactional accounts may put them off. Therefore, banks with fewer assets should look at other options to create high yield niches that have proven resilient as funding costs have risen – such as non-standard mortgages, unsecured personal loans, second change mortgages, and unsecured SME lending. Equally, there could also be opportunity in forward flow to ensure the smaller banks remain viable and offset the risk of their saving accounts to larger lenders, while receiving an injection of capital from the instant profits forward flow provides.

In the current economic climate, current vs saving account capability appears to be the biggest single swing factor between the funding costs of ‘challenger’ banks and the gap may grow over the next 24 months as term deposits refinance. With the right guidance, there are options available to diversify offerings and reduce the cost of funding across the board.

So what?

Many lenders are well-positioned to face rising yield curves – well-leveraged non-bank lenders or banks that already have current account offerings – could utilise this time to grow their share in attractive lending niches where competitors with expensive funding are retreating.

For those with tighter margins in via market funding there is opportunity in strategic partnerships through M&A and forward flow options, notably with banks. These strategies would ensure the longevity of businesses and create partnerships to prosper from current market developments.

What is clear, is the current cost of funding issue is here for the near to medium-term. Understanding the range of solutions and opportunities, with a full balance sheet advisor, such as Alantra, will be key to solving issues and capitalising upon opportunities that will arise in the coming six to nine months.

[1] Three listed NBFIs have been selected to illustrate a wider trend [2] Source: UK data: Bloomberg, BPSWS2 BGN Curncy, November 2022. SONIA data: Concept ABS