Alantra generated revenues of €177.9 million (-17.0%) and net profit of €29.0 million (-27.7%) in 2020

Date 25 February 2021

Type Financial Results

Financial Results

- Net revenues reached €177.9m (-17.0%), amidst a challenging economic environment. As anticipated in previous reports, the pandemic had a significant impact on the second and third quarters of the year, while the last quarter was particularly strong with €66.0m in net revenues (+3.6% YoY).

- Investment Banking: net revenues were stable compared to last year’s record results of €119.3m (-1.9% YoY), with seven geographies contributing more than 8% each of the total revenue.

- Credit Portfolio Advisory: net revenues were €28.7m (-34.3% YoY) in a context of lower activity in Europe – Deal-making activity in non-performing loans suffered a 34% drop in 2020 to record its lowest level in the last five years[1].

- Alternative Asset Management: net revenues decreased to €28.0m (-41.0% YoY), mainly driven by lower performance fees (-80% YoY) and a change in the consolidation perimeter[2]. Net revenues from management fees were €24.2m (-6.2% YoY).

- Operating expenses decreased by -17.6% to €141.4m, in line with net revenues, mainly driven by a decrease in variable retribution (-29.2% YoY), and adjustments in certain businesses and other operating expenses.

- Net profit attributable to the parent reached €29.0m (-27.7%), of which €29.3m corresponds to the fee business, €1.4m to the portfolio, and -€1.7m to other results.

- The Group further reinforced its balance sheet, with €246.4m of shareholders’ equity attributable to the parent; €163.8m of cash, cash equivalents, and liquid assets[3]; €41.7m of a portfolio of investments in products managed by the Group; and no financial leverage.

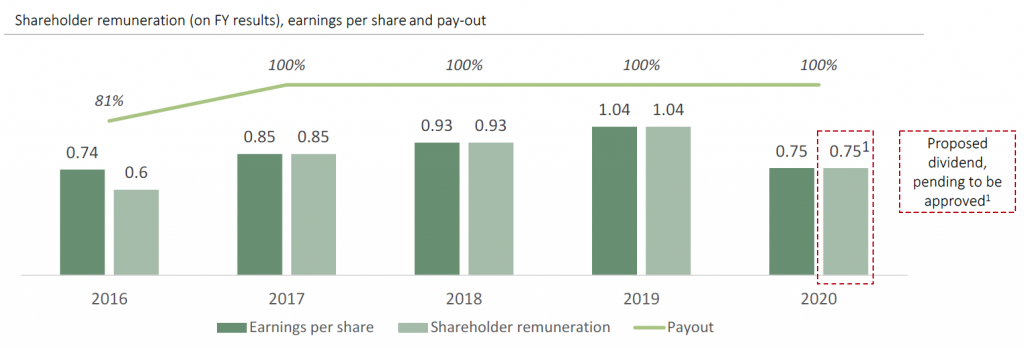

- Following the full pay out of profits to shareholders during the last three years, the Board of Directors will propose to the Annual General Meeting (April 2021) the full pay out of the 2020 consolidated profits (€0.75 per share), of which €0.40 per share will be paid in May and the remaining €0.35 per share in November.

Business activity

- Investment Banking: an international and diversified mid-market business.Alantra completed the same number of transactions (120) as in 2019, achieving remarkable levels of activity in some of the most dynamic M&A sectors across the globe, such as technology (31), and healthcare (23). Alantra ranked as the #5 independent advisor in Europe and #5 independent advisor to Private Equity Houses across the globe.

The Group continued to invest in strengthening its specialized service offering, including the appointment of 10 senior professionals.

- The Credit Portfolio Advisory division advised on over 20 deals for a total volume of €12bn. Notable transactions include advising Eurobank on the largest Greek NPL securitization to date (Project Cairo), with a total value of €7.5bn; advising Piraeus Bank on the signing of its first NPE securitization (Project Phoenix), with a total value of €1.9bn; and advising on one of the leading RPL divestments conducted in the Spanish market in 2020 (Project Eume).

In response to the challenges that many European corporates and banks are facing, Alantra announced the incorporation of Francesco Dissera to lead a team of more than 15 senior professionals dedicated to advising on securitization and secured financing transactions across Europe. The Firm also opened new offices in China, Brazil and added key senior professionals to help strengthen its global practice.

- Additional steps towards growing the asset management business by launching new vehicles, raising funds, and completing strategic partnerships. Alantra partnered with a leading insurance group, Mutua, which will support its growth strategy; and acquired a strategic stake in a European private lender, Indigo Capital.

In 2020, Alantra and its strategic partners have been able to raise more than €1.5bn amidst a challenging market environment.

[1] Source: Debtwire European NPL Database – FY 2020

[2] Alantra Wealth Management was partially sold to Mutua and since June 2019, is considered under the equity method

[3] €89.6m of cash and cash equivalents and €74.2m invested in a monetary fund included under non-current financial assets