Alantra becomes a strategic partner to MCH Investment Strategies to support its growth plan and internationalisation

Date 3 March 2021

Type Corporate News

MCH Private Equity exits as a shareholder

- Alantra and MCH Investment Strategies have reached an agreement whereby Alantra will acquire a 40% stake in MCH Investment Strategies.

- MCH Investment Strategies is an independent product specialist that selects best-in-class international asset management firms and structures alternative investment funds for distribution to Spanish, Italian, and Portuguese investors. Founded in 2008, the firm currently represents or manages more than €3bn AuM.

- MCH Investment Strategies was founded by Tasio del Castaño and Alejandro Sarrate with the support of the partners of MCH Private Equity, who held a minority stake in MCH Investment Strategies until their exit. MCH PE and MCH Investment Strategies will continue to operate as two completely independent entities as they have done to date.

- By partnering with Alantra, MCH Investment Strategies will accelerate its growth plan by expanding its geographical reach across Europe, growing its investor base through access to a wider pool of institutional investors, and increasing its product offering by reaching new alternative asset managers.

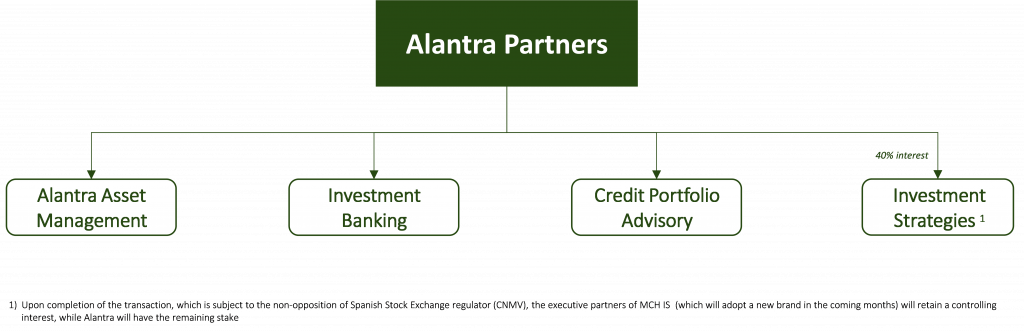

- Through this partnership, Alantra will expand its financial services offering by adding a new business pillar to its Investment Banking, Credit Portfolio Advisory, and Alternative Asset Management businesses.

Madrid, 3 March 2021 – Alantra and MCH Investment Strategies have reached an agreement whereby Alantra will acquire a 40% stake in MCH Investment Strategies and become its strategic partner to support its growth plans. Through this transaction, the partners of MCH Private Equity will exit the company’s shareholding structure after 12 years as minority shareholders. Upon completion of the transaction, which is subject to approval from the Spanish securities market regulator (CNMV), the firm will adopt a new brand and the executive team will retain a controlling interest.

“This transaction lays the foundations for a new growth phase for the firm by attracting a top-tier strategic partner, guaranteeing our independence and reinforcing our commitment to building a broad and solid long-term executive partner base,” said Alejandro Sarrate and Tasio del Castaño, founding partners of MCH Investment Strategies. “With Alantra, we gain a global partner that will provide us with the strategic and institutional support to enter into a new phase of international growth while continuing to improve the service we offer to our investors.”

“MCH Investment Strategies is in a privileged position to scale its business in the coming years: a great management team that shares our entrepreneurial culture, a high-quality product offering and exclusive agreements with leading international alternative asset managers. We are very pleased with the agreement reached and look forward to working with Tasio, Alejandro and the entire MCH Investment Strategies team to help them achieve their growth plans,” said Santiago Eguidazu, CEO of Alantra.

José María Muñoz, founding partner of MCH Private Equity, commented: “We are proud to have shared an enormously successful project with the managers of MCH Investment Strategies during all these years and we hope that in this new phase, with the support of Alantra, MCH Investment Strategies will continue to consolidate its position as one of the leading European firms in the field of fund selection, structuring and distribution.”

About MCH Investment Strategies

Founded in 2008, MCH Investment Strategies is an independent investment products firm specialising in the selection of international asset class managers with proven talent and the structuring of alternative investment products which it markets to Spanish, Italian and Portuguese institutional clients and family offices. Its activity consists of (i) the representation of asset managers specialised in liquid strategies with a proven ability to generate long-term added value and (ii) asset management in illiquid alternative strategies, in which MCH Investment Strategies structures and markets investment vehicles in alliance with renowned international asset managers such as Alpinvest (private equity), Apollo (private debt), or JP Morgan (real assets).

About Alantra

Alantra is a global alternative asset management, investment banking, and credit portfolio advisory firm focusing on providing high value-added services to companies, families, and investors operating in the mid-market segment. The Group has over 540 professionals across Europe, the US, Latin America, and Asia.

In Alternative Asset Management, Alantra offers its clients unique access to a wide range of investment strategies (direct investments, fund of funds, co-investments, and secondaries) in six highly specialized asset management classes (private equity, active funds, private debt, infrastructure, real estate, and venture capital) as well as private wealth management services. As of 31 December 2020, assets under management in direct investments stood at €2.6bn, while funds raised since inception in funds of funds, co-investments and secondary funds stood at €11.7bn.