Alantra Asset Management partners with Mutua to accelerate its expansion plan

Date 27 February 2020

Type Corporate News

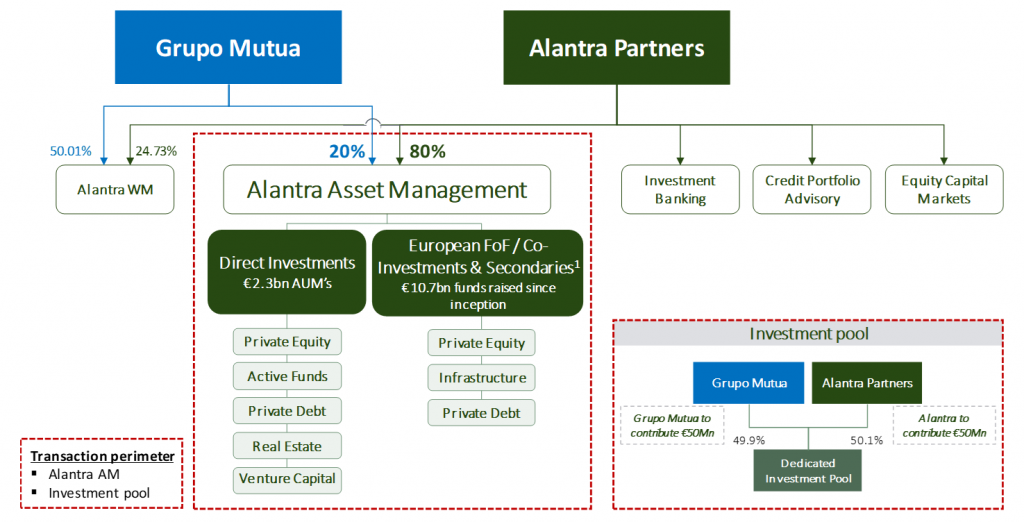

Madrid – Alantra and Grupo Mutua have reached an agreement under which Mutua will contribute €45m to finance the growth plan of Alantra Asset Management and, in return, will obtain a 20% stake in the division. Both parties have agreed on an earn out of up to €11.2m.

As part of the agreement, Alantra and Mutua have agreed to create a €100m investment pool aimed at investing in products managed by Alantra’s asset management division (GP commitments), in which both parties will contribute €50m each. Alantra’s contribution includes its current portfolio of investments in its own vehicles.

Through this transaction, which is only subject to the non-opposition of Spanish Stock Exchange regulator (CNMV, by its acronym in Spanish), Mutua will provide the financial resources necessary for the growth, both organic and inorganic, of Alantra’s alternative asset management platform. The agreement is also a significant reinforcement of Alantra’s capital raising capabilities.

This announcement follows Alantra’s acquisition of a strategic stake in Access Capital Partners, completed in 2019, one of the European leaders in the management of funds of funds, co-investments and secondary funds with €10.7bn in funds raised since inception.

Santiago Eguidazu, Executive Chairman of Alantra, notes that “this transaction strengthens our value proposition to investors by significantly scaling, internationalizing and diversifying our alternative asset management business. The incorporation of Grupo Mutua strengthens our alignment of interests with investors and reaffirms our commitment to run a business free of conflicts of interests”

For Ignacio Garralda, Chairman of Mutua Madrileña, “the partnership with Alantra Asset Management allows Mutua to further expand its presence in alternative asset management. This agreement responds to Mutua’s 2018-2020 Strategic Plan, which intends to diversify its investments and grow its wealth management business as one of its key pillars. This is the fourth transaction carried out by Mutuactivos in the asset management segment in the last 12 months, being able to position itself as the first independent firm Spain with over €7.8bn in assets under management.”